Ameritrade Review

Min Deposit

$2,000

Leverage

50:1

Deposit Bonus

Zero prowizji

Regulation

CFTC

SEC

Platform

thinkorswim

Trade Architect

Ameritrade Web

Ameritrade została założona w 1971 r. w Stanach Zjednoczonych i od tego czasu stała się jedną z największych firm świadczących usługi finansowe na świecie, z ponad 7 milionami finansowanych kont klientów i ponad 3 miliardami dolarów przychodów rocznie.

Spółka jest licencjonowana i regulowana w USA przez CFTC i amerykańską Komisję Papierów Wartościowych i Giełd (SEC).

W 2009 r. Ameritrade nabył platformę „thinkorswim”, która jest jedną z najbardziej nagradzanych platform handlowych, oferującą opcje, akcje i transakcje forex, zarówno dla klientów detalicznych, jak i instytucjonalnych.

Ameritrade jest w rzeczywistości jednym z założycieli branży handlu online, ponieważ był pierwszym brokerem, który wprowadził koncepcję rejestracji klienta online, a także był pierwszym brokerem, który oferował handel online w 1994 roku.

Wprowadzenie

TD Ameritrade przekształciło się w firmę o nazwie First Omaha Securities, założoną w 1971 roku, która skorzystała z decyzji Komisji Papierów Wartościowych i Giełd, aby wyeliminować praktykę stałych prowizji maklerskich w dniu 1 maja 1975 roku.

Firma brokerska ma siedzibę w Omaha w stanie Nebraska, a litery TD pochodzą od Toronto-Dominion Bank, który jest największym udziałowcem spółki, oferującym zarówno detaliczne, jak i instytucjonalne usługi finansowe.

Firma przerowadziła swoje IPO (wejście na giełdę), w marcu 1997 roku podczas łączenia jej różnych jednostek maklerskich w jednego pod nazwą, Ameritrade, Inc., i rozpoczęła swoją pierwszą ogólnokrajową kampanię reklamową, wraz z filozofią cenową, która trwa do dziś.

Ameritrade był zaangażowany w wiele innowacyjnych etapów osiągniętych w dzisiejszej branży, takich zdobyli oni szerokie uznanie za realizację pierwszego handlu online w 1994 r., wprowadzenie pierwszej w branży gwarancji wykonania transakcji wynoszącej 10 sekund, ale także doprowadzenie całego procesu otwierania konta online jako pierwsi na początku tysiąclecia.

Ameritrade jest regulowany przez CFTC i jest również notowany publicznie na NASDAQ pod symbolem AMTD.

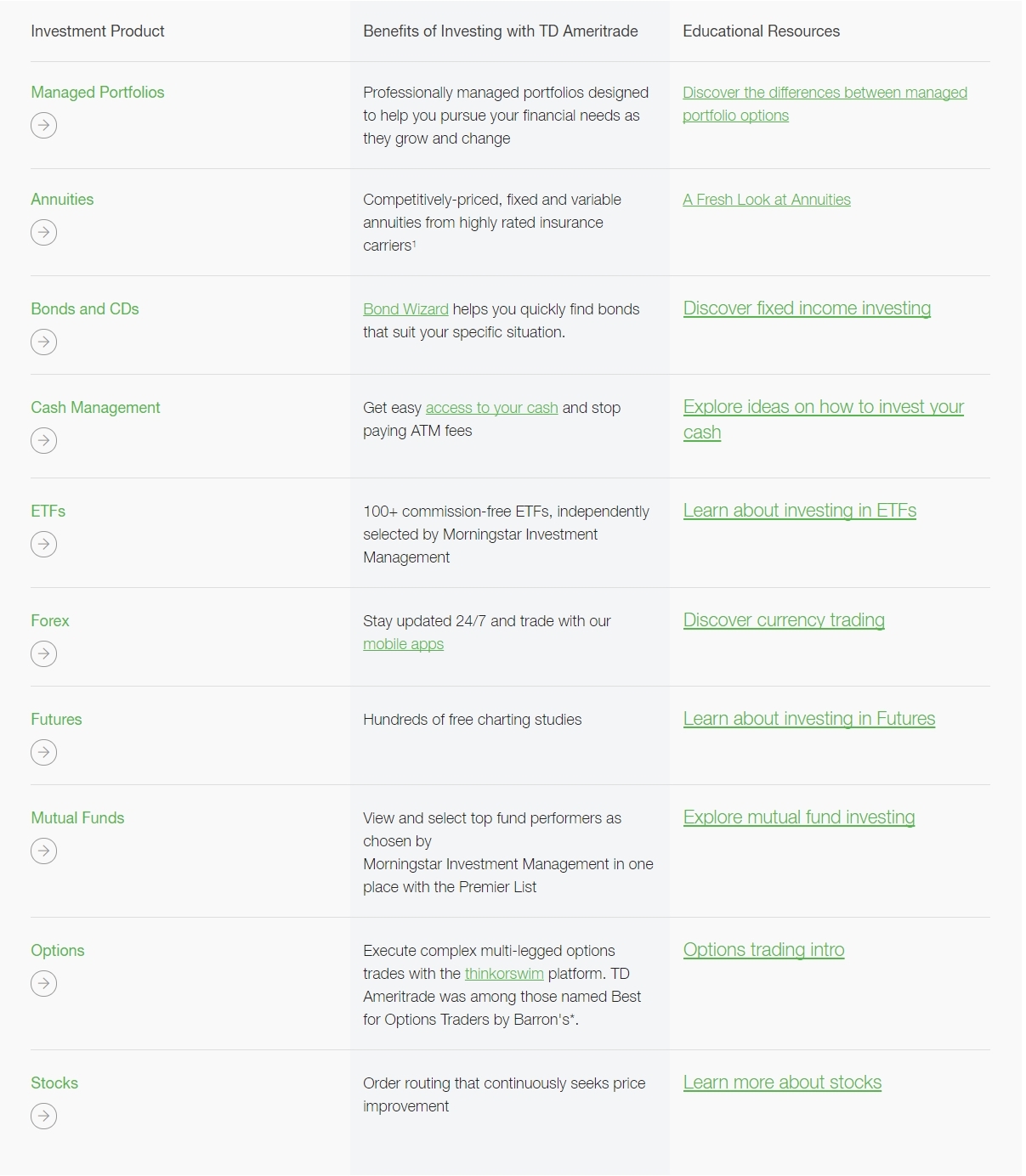

Produkty Ameritrade

Ameritrade oferuje szeroką gamę produktów inwestycyjnych, które z pewnością zaspokoją apetyt wszystkich inwestorów. Warto zauważyć, że Ameritrade oferuje oszałamiające 131 różnych par forex!

Oprócz typowego rynku Forex, akcji i opcji oferowanych przez większość brokerów, Ameritrade konsoliduje produkty inwestycyjne oferowane przez innych indywidualnych brokerów i zarządza oferowaniem portfeli zarządzanych, funduszy wzajemnych, funduszy ETF i innych za pośrednictwem platformy Thinkorswim.

Ameritrade Trading Conditions

As for Ameritrade trading conditions, the commission rate charged by the broker is slightly higher than average. The commission rate is fixed and varies on the type of instruments traded. Nevertheless, while investors at Ameritrade may be paying premium commission rates, they also get to access premium research data provided by the broker.

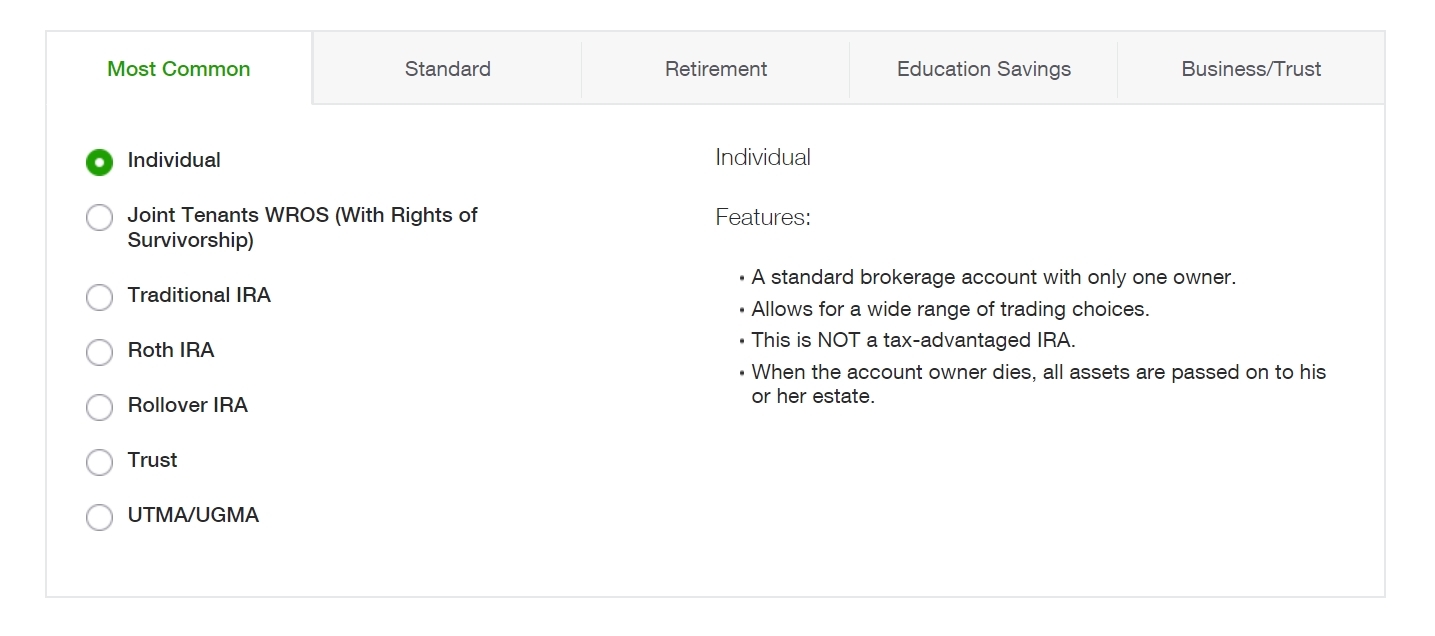

Rodzaje kont Ameritrade

Ameritrade oferuje wiele rodzajów kont dla klientów, firm, a nawet funduszy powierniczych do wyboru. Ze względu na mnóstwo produktów i usług oferowanych przez Brokera dostępnych jest kilka typów kont, jak pokazano na poniższym zrzucie ekranu.

Liczba wyborów jest tak duża, że wielu naszych czytelników uznało je za mylące.

Ameritrade Commissions & Fees

Ameritrade charges a commission of the trades executed on its trading platform. The commission rate varies according to the type of instruments traded. For stocks, the commission rate is $6.95. For options, the commission is $6.95 + 0.75 per contract. Apart the above mentioned, Ameritrade also provided commission free trades for more than 300 ETFs and 4000+ funds. However it should be noted that in order to qualify for commission free trading on ETFs, the investor must hold his position for a minimum of 30 days. Other fees which traders at Ameritrade might incur include a bank wire transfer fee of $25. For ETF positions which are held for less than 30 days, then there is a short term trading fee of $13.90 which is payable.

Platformy Ameritrade

Być może najbardziej imponującą rzeczą w TD AmeriTrade jest ceniona platforma komputerowa „thinkorswim”. Platforma może być najlepszą rzeczą, jaka przytrafiła się analitykom technicznym, którzy publikują na wykresach i wskaźnikach.

Platforma zawiera kilka bardzo fascynujących funkcji, które pomagają handlowcom, takich jak kalendarz ekonomiczny na żywo, tickery, najnowsze wiadomości rynkowe, okno telewizji CNBC, aby być na bieżąco ze wszystkimi wiadomościami rynkowymi, a także linki do dostępu do najpopularniejszych narzędzi na platformach.

Dzięki platformie thinkorswim klienci mogą wybrać z 131 różnych par walutowych i mieć dostęp do ponad 400 wskaźników technicznych, które można dowolnie modyfikować i grupować według potrzeb za pomocą narzędzia thinkScripts.

Wszystkie powyższe elementy są również częścią aplikacji mobilnej thinkorswim na Androida, która przyjęła również pewne innowacyjne funkcje, takie jak autoryzacja handlu odciskami palców, zaawansowane zamówienia grupowe i inne.

Wreszcie, Ameritrade uwzględnił również funkcje społecznościowe, wprowadzając wiele pokojów rozmów dla handlowców w celu omówienia swoich pomysłów handlowych, a także dodając myTrade, który pozwala klientom zobaczyć, co inni handlują.

Is Ameritrade Mobile Friendly?

Ameritrade’s choice of trading platforms also extends to mobile phones. The broker has also made the platform available for iOS powered smartphones. With the mobile app, traders at Ameritrade can enjoy the same functionalities as the web based trading platform. In fact, the mobile app even has access to level II quotes which is not available on the web platform.

Promocje w Ameritrade

Ameritrade oferuje inwestorom 60 dni bez prowizji w zależności od depozytów. Poniższy diagram przedstawia zakres depozytów, aby ktoś mógł się zakwalifikować.

Strona internetowa

Strona internetowa Ameritrades jest jedną z najlepszych, jakie znaleźliśmy w branży, ponieważ jest bardzo przejrzysta i precyzyjna.

Firma udaje się przekazać swój komunikat, który jest dość duży ze względu na różne rodzaje produktów, które oferują, jednak robią to niesamowicie.

Oprócz informacji o firmie i formularzy rejestracyjnych Ameritrade oferuje również informacje rynkowe i informacje o giełdzie, które są łatwo dostępne po wprowadzeniu słowa kluczowego lub nazwy akcji w pasku wyszukiwania menu.

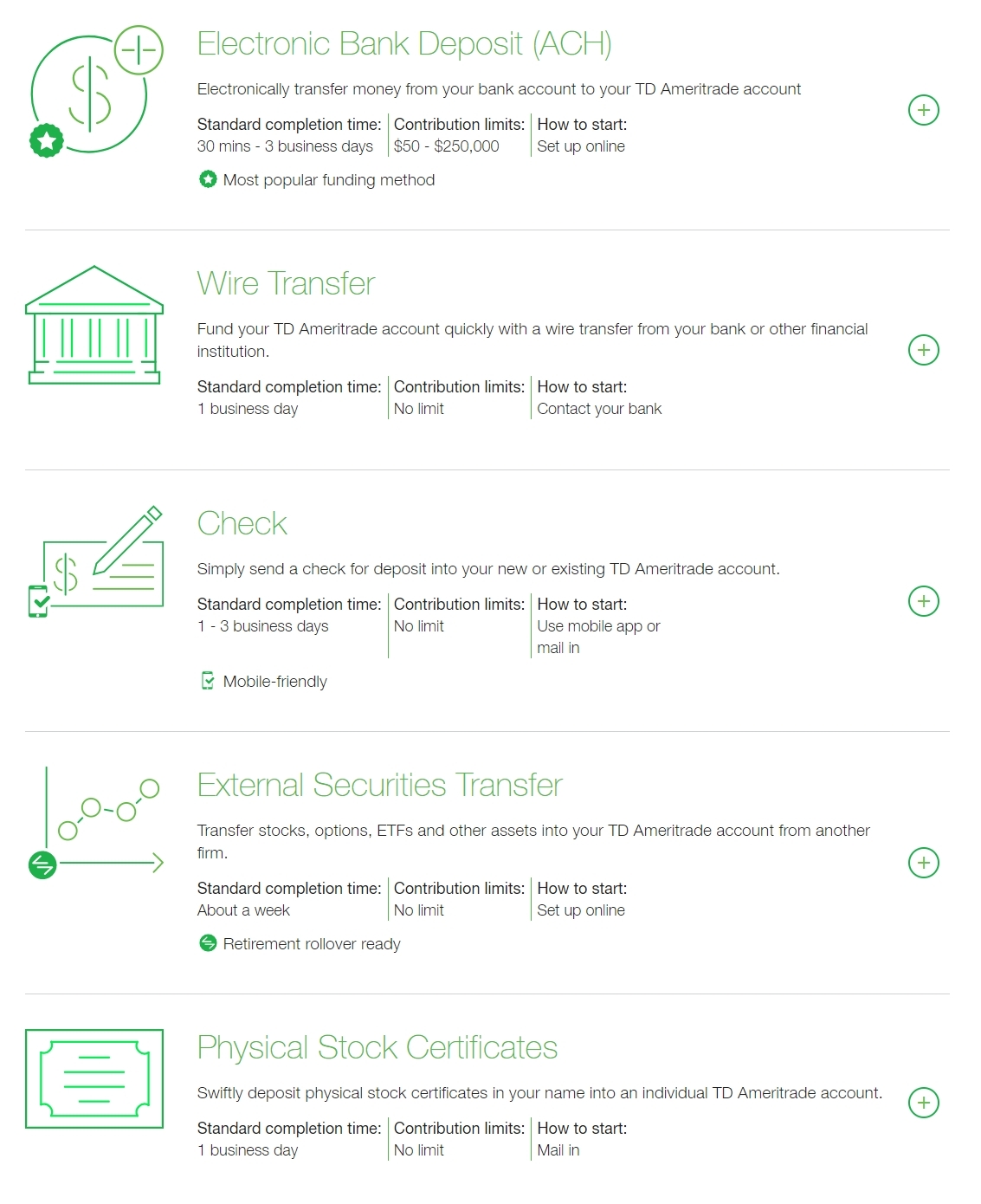

Wpłaty / wypłaty w Ameritrade

Nie ma minimalnej kwoty wymaganej do otwarcia Konta w Ameritrade, jednakże wymagany jest depozyt w wysokości 2000 USD, aby móc wziąć pod uwagę przywileje dotyczące depozytu zabezpieczającego i opcji, niezależnie od oferty promocyjnej.

Metody płatności oferowane przez Ameritrade bardzo różnią się od typowych metod stosowanych u europejskich brokerów, jednak ACH jest powszechnie stosowany w Stanach Zjednoczonych i jest bardzo wydajny.

Ameritrade Customer Support

For customer support at Ameritrade, traders can reach the support team through chat applications such as Twitter, Amazon Alexa, Apple Business Chat or through the telephone 24/7.

Ameritrade Research and Education

One of the major plus points about Ameritrade is the educational support provided by the broker. The broker has made available a wide array of support materials such as articles, videos, seminars and branch presentations.

Noteworthy Points to Mention for Ameritrade

One key point which makes Ameritrade stands out from other brokers in the industry include making it easy for anyone to open an account by not imposing any minimum account deposits on some of its trading accounts. Another attractive factor which makes Ameritrade stand out is its wide range of trading instruments. The range of tradable instruments covers asset classes such as forex, futures, cryptocurrencies, ETFs and mutual funds.

Conclusion for Ameritrade

As a discount broker, Ameritrade is definitely not the cheapest broker around. Nevertheless, the broker has managed to cover all the prerequisite bases such as having a wide range of instruments available for trading and a reliable trading platform. In addition the broker has also been able to provide value for money by providing access to premium research data and a comprehensive trading educational package.

User Reviews

5

based on 1 ratings

Recovery/investment advice/hacker for hire

I have gotten back all my lost fund and bonus from binary option. They stocked all my trading capital and deprived me access into my account for over two months now, after I’ve invested $200K with my hard earned money. Thought I was not gonna see this day, but as God may have it, today I’ve got back all my money back for real. I will forever remain grateful to God. If you’ve been locked out from logging into your binary option trading account or you are unable to make withdrawal from your brokers account or you need an advice on where and how to invest in any broker maybe because your broker. kindly reach out to hightechcoininvestment @ gmail com Whatsapp:+1(704)7690765 and they will guide you on steps to take to regain access to your account, make withdrawal freely and easy, as well as recover all your lost funds