eToro レビュー

最小預金額

$200

レバレッジ

30:1

Deposit Bonus

NA

規制

FCA

CySEC

ASIC

プラットフォ-ム

eToro WebTrader

eToro Mobile Trader

膨大な数の取引商品を探しているトレーダーと、成功したトレーダーをコピーしたいトレーダーであれば、eToroをブローカーに選ぶのがすばらしい選択であると判明するでしょう。eToroプラットフォームは非常に使いやすい一方で、顧客が取引できる商品が大量に詰まっています。

eToroで一番人気の機能は、明らかにソーシャルトレーディング/コピートレーディング・オプションで、トレーダーに「人気トレーダー」になり、他の顧客が人気トレーダーのコピーをすると稼げるチャンスをあたえています!

ソーシャルトレーディング&コピートレーディングは新規トレーダーを引きつけるものの、eToroはスプレッドが高いだけでなく、最低入金額も$1,000以上と非常に高いため、実際は初心者トレーダーはeToroへの登録を思いとどまっています。

最後に、出金リクエスト問題がオンラインで取り沙汰され続けていますが、eTradeはキプロス証券取引委員会 (CySEC)(キプロス)と金融行為規制機構 (FCA)の規制をうけているため、この問題は割合早く解決する傾向があります。

eToro Introduction

eToroはソーシャルトレーディング・プラットフォームであり、オンライン投資会社で、2006年イスラエルのテル・アビブで RetailFXとして設立されました。当社は後に、eToro (Europe) Ltdと社名を変更した時に、「eToro」というブランド名がつきました。キプロス証券取引委員会 (CySEC)からは登録番号200585 、英国の 金融行為規制機構 (FCA)からは登録番号07973792を取得し、2つの管轄区の規制を受けています。

eToroのキプロス本社ビルは、リマソールのカニカ・ビジネス・センターであり、英国本社はロンドンのカナリーワーフです。また、イスラエルのテルアビブにも研究開発事務所があります。

また、 IC Marketsと提携しており、オーストラリアでの存在感を増しています。

eToroは設立以来、飛躍的に成長しており、大きく発展して、13言語でサービスを提供し、今日までになんと、 16もの賞を受賞しています。その一部を以下にあげます。

- Game-changing technologies across Europe 2013(2013年度欧州革新的技術賞)

- Best use of social media 2012(2012年度ソーシャルメディア最大活用賞)

- Best use of customer communications and social networking technology 2012(顧客コミュニケーションおよびソーシャルネットワーク技術最大活用賞)

eToro ブローカー商品

ソーシャルトレーディング・オプションは別にしても、eToroがこれほど人気を集めている理由の一つは、大量の金融商品で、仮想通貨取引の最新トレンドも満たしているからです。これほど多くの金融商品を取引する可能性は、あらゆるトレーダーにとって魅力があるように思えるかもしれませんが、eToro最高のトレーダーのポートフォリオで判断すると、おそらく、全員がよく知っている商品だけを取引するでしょう。eToroが提供する金融商品の一部を以下にあげます。

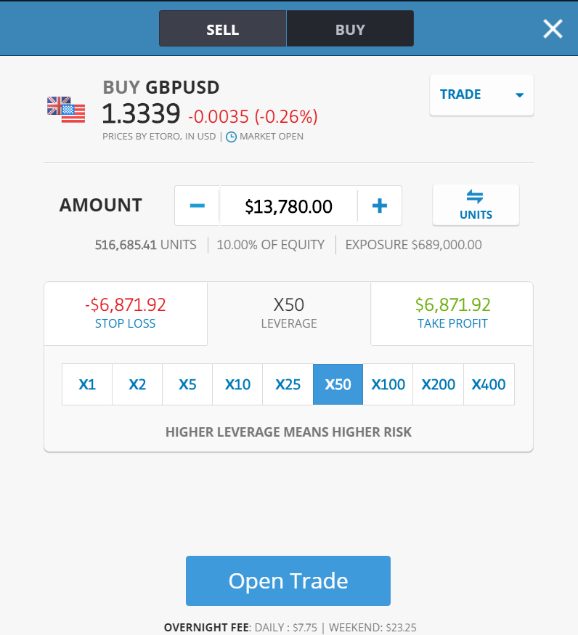

- 通貨ペア47。この中には、ハンガリーフォリント (HUF)、 メキシコペソ (MXN)、シンガポールドル(SGD)、ロシアルーブル(RUB)、南アフリカランド(ZAR)、ポーランドズウォティ(PLN)、香港ドル(HKD)、中国人民元 (CNY)、さらにはトルコリラ (TRY)までも含む流動性の低い通貨のみならず、EUR/USD(ユーロ/米ドル)、GBP/USD(英ポンド/米ドル)、USD/JPY(米ドル/日本円)のような極めて流動性の高い通貨ペアの一部も含まれています。

- 仮想通貨7。eToroが提供しているのは、ビットコイン、ビットコインキャッシュ、イーサリアム、イーサリアムクラシック、ライトコイン、ダッシュ、リップルのような最高の時価総額がある仮想通貨だけです。

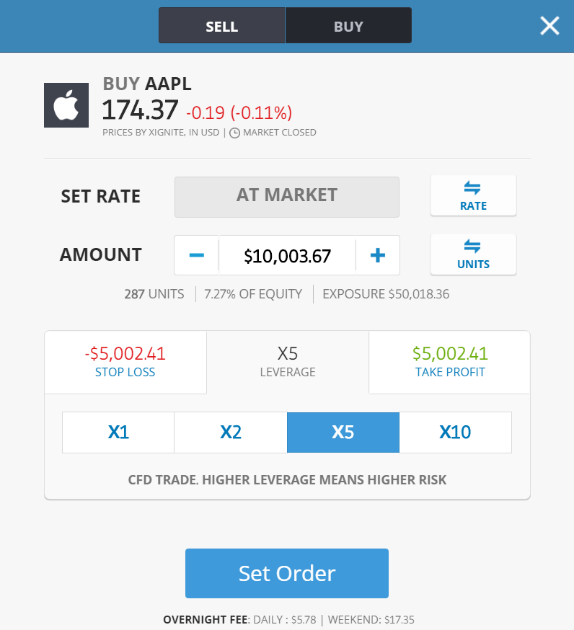

- 8取引所の株式959。これには、フェイスブック、マイクロソフト、インテル、フォード、ベストバイ、マクドナルド、ペプシコ、ドイツテレコム、BMW、グラクソ・スミスクラインなど多数が含まれます。eToroでCFDを購入するときに、株式を所有していないということは注目すべきです。

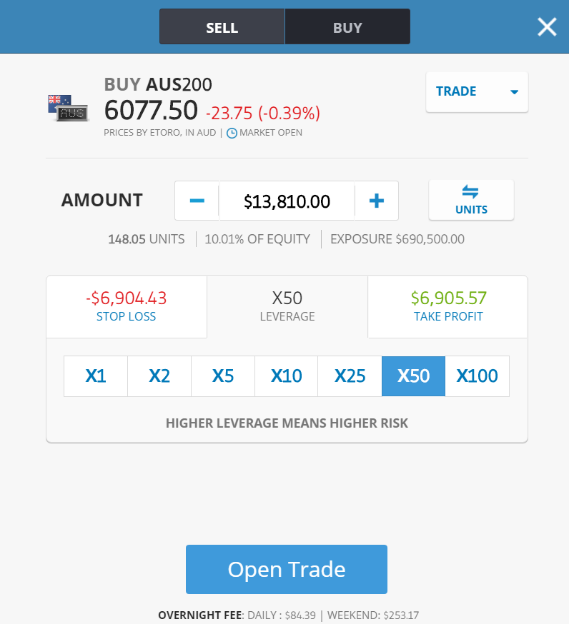

- 指数12。米ドル指数、ナスダック100、S&P500、英国100、中国50、ドイツ30など。

- 商品6。これは最も頻繁に取引されている商品である金、銀、銅、プラチナ(白銀)、石油、天然ガスです。

- 上場投資信託 (ETF) CFD59。米国天然ガス(UNG)、エマージングマーケット指数(EEM)、iシェアーズジャパン(EWJ)、ゴールドマイナーズETF (GDX)、Vix短期先物 (VXX)など。

- ソーシャルトレーディング。おそらく、eToroが名声を得た理由です。eToroのソーシャルトレーディング・プラットフォームは基本的に、プラットフォームで人気があり、利益をあげているトレーダーのコピートレーディング・システムです。つまり、トレーダーがよい結果を上げると、顧客はそのトレーダーをフォローし、自分の口座で取引をそのままコピーします。

eToro 取引条件

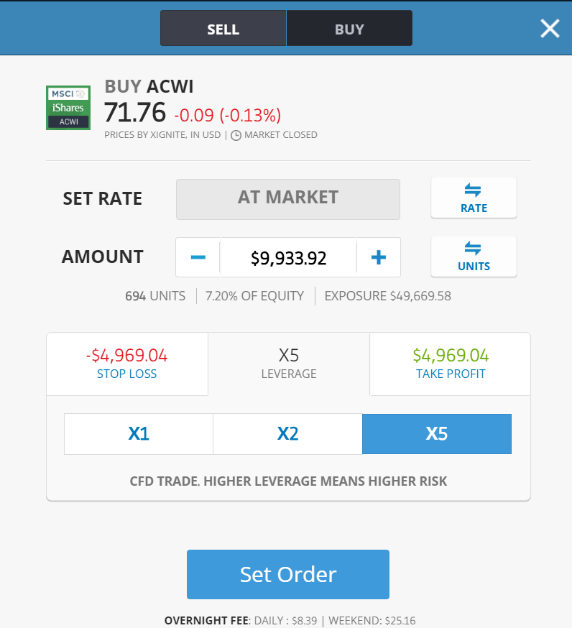

eToroの取引条件は、業界他者と同じです。レバレッジについては、eToroは顧客に、取引している商品に応じて、様々なオプションを提供します。たとえば、株式CFD取引を実施する時は、顧客はレバレッジを1:2、1:5、1:10に増加するオプションがあります。指標では、追加レバレッジレベルは1:25、1:50、1:100が認められます。FXの場合は、eToroは1:200と1:400という追加レバレッジレベルを提供しますが、これはブローカーが提供する最高レベルのものですが、業界で一番高いものというわけでは絶対にありません。最後に、顧客が仮想通貨取引をする場合、レバレッジは固定された1:1で契約しなければなりません。1:1は実際は、仮想通貨のボラティリティが巨大で、ブローカーのみならずトレーダーも大きな損失を被る可能性があるため、2017年末の時点で、ブローカーの間で人気がでるようになりました。

eToroの執行は、FX取引の時は特に、よくなる可能性があります。プラットフォームをテストしている最中に、注文の執行は一様でないことに気がつきました。たとえば、FX取引では、注文の執行に数秒かかることもありますが、他の商品はそれ以上に速く執行されました。

以前はボーナスを提供していましたが、この記事を記述している時点では、eToroが顧客に提供するのは、「お友達紹介」ボーナスだけです。顧客を1人紹介するたびに、最初の入金の後、両方(紹介した側と紹介された側)が20ドルを受け取ります。友人紹介ボーナスの最大額は200ドルです。

EU規制当局が法令に最新の変更を加えた後、ブローカーは入金ボーナス、高いレバレッジなど、顧客にとってインセンティブとなる一定のeToroが提供する要素を調整しなければならなくなりました。

eToro 口座の種類

eToroは、4種類の取引口座を顧客に提供しています。私たちはこの取引口座に満足しています。新米トレーダーと経験豊富なトレーダーの区別なく、あらゆるトレーダーにふさわしいからです。この4種類の取引口座は次の通りです。

- 仮想ポートフォリオ口座。このタイプの口座は、誰にでも利用できるものであり、資金は不要です。他のブローカーでは標準デモ口座にあたるもので、別の名前となっています。戦略を試し、eToroの取引プラットフォームを学ぶのに最適です。

- リアルポートフォリオ口座。これは本物の資金を使って取引をするために使われるスタンダード口座です。

- イスラム口座。このタイプの口座は、宗教上の理由があるイスラム教徒だけに提供されます。イスラム口座は24時間を超える取引に対して利息を提供しません。ロールオーバーはなく、レバレッジに利子はなく、手数料もかかりません。代わりに、eToroが得るこの種の口座の収入はスプレッドのみとなります。

- 法人口座。このタイプの口座は、リアルポートフォリオ口座と同じで、唯一の違いは、このタイプの口座は企業体だけを対象としています。

実質的には、eToroのリアル口座は一種類だけです。これは、eToroが遅れをとっている分野の一つです。eToroは現在、口座となると、多様なオプションを多数、提供します。マイクロ口座とミニ口座は他のブローカーの中でも人気であり、取引単位は、100,000の代わりに1,000/10,000であり、実際に貨幣を使って取引をしたい新米にとって理想的です。顧客に対して大成功を収めている他の口座が、ゼロスプレッド口座です。この口座ではブローカーはECNのように、スプレッドの代わりに手数料を請求します。

eToro 手数料と費用

FXブローカー他社と比較すると、eToroのFX取引スプレッドは比較的高くなっています。EUR/USD(ユーロ/米ドル)とGBP/USD(英ポンド/米ドル)のような非常に流動性の高いペアは、ロンドンとニューヨークの立会時間中に平均、3ピップと4ピップでした。7ピップのスプレッドだったペアまであります(EUR/AUD(ユーロ/豪ドル)とEUR/CAD(ユーロ/カナダドル))。一番高いスプレッドは最大20までになる可能性もあります(PLN/ZAR(ポーランドズウォティ/南アフリカランド)ペア)。通貨ペアにも、ロールオーバー費用がかかります。特定通貨の金利に応じて、プラスになるときもマイナスになるときもあります。

仮想通貨のスプレッドは(イーサリアムの場合)その通貨価格の2%、ビットコインキャッシュとイーサリアムクラシックの場合は5%である一方、ビットコインのスプレッドは一番低く、0.70%です。すべての仮想通貨のショートポジション(売り)のロールオーバー費用はマイナスである一方、ロングポジション(買い)のロールオーバー費用は0です。

株式CFDは、特定株式とその業界に応じた変動スプレッドです。たとえば、アルコア(AA)のような一部の株式のスプレッドは価格の0.24%(大半の株式CFDのスプレッド)であり、一方アップル (AAPL) のスプレッドは8ポイントです。また、顧客の売買に関係なく、すべての株式に費用がかかります。

商品のスプレッドは石油の5ピップから金の45ピップとなっていますが、顧客が石油と天然ガスの売却を決定すれば、プラスのオーバーナイト費を受け取ります。ただしeToroの指標は最高のスプレッドとなっており、SPX500の100ピップより、日経225の1000ピップまでとなっています。オーバーナイト費用は、この指標の一つの売買共にマイナスです。

ETFの場合はスプレッドは0.24%と定額になっており、すべてのETFの売買に対してマイナスのオーバーナイト費用がつきます。

eToroでは、4ヶ月以上、ログインのない口座に対して、この費用を控除できる資金がある場合は、一ヶ月につき5ドルの休眠口座手数料もかかります。トレーダーがログインした場合、口座は再び、稼働口座と見なされるようになります。

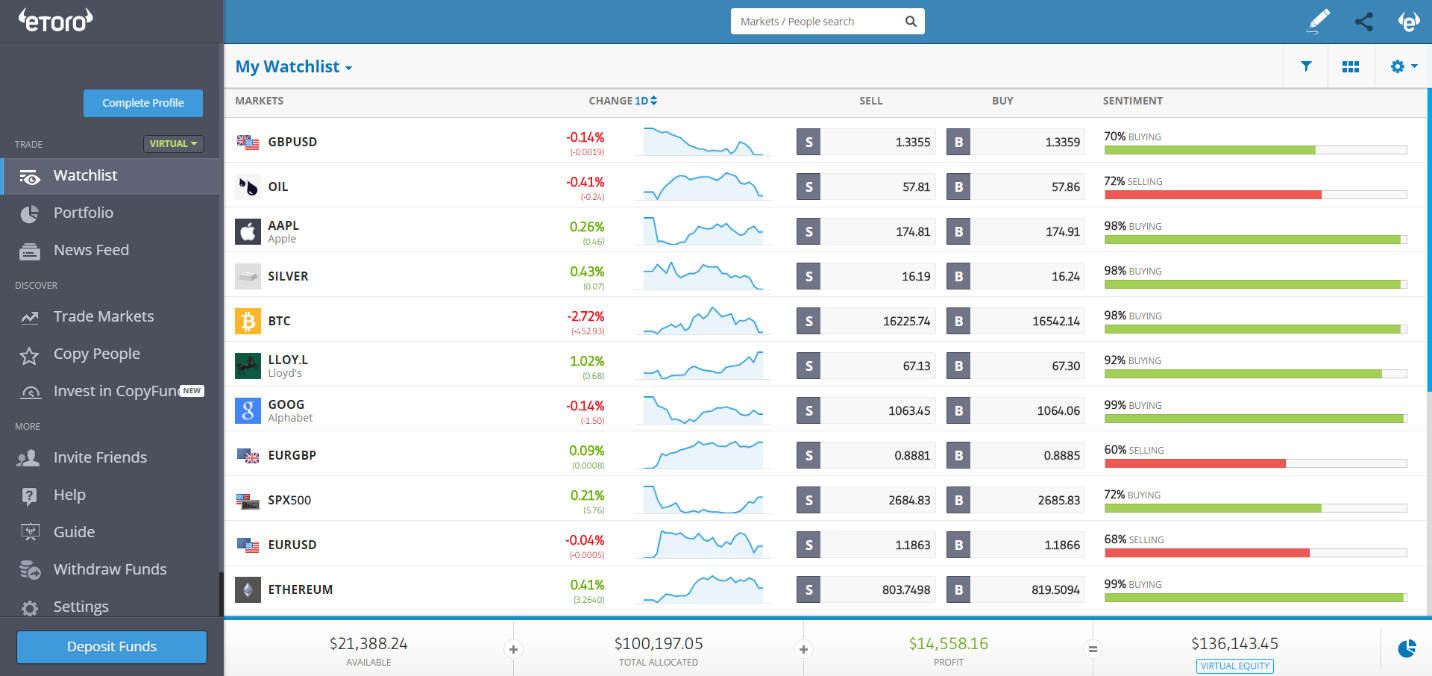

eToroオプションプラットフォームとツール

eToroはデスクトップユーザー向けに一つだけ Webベースのプラットフォーム、AndroidとiOS向けにモバイルアプリを提供しています。どちらも13カ国語で利用できます。

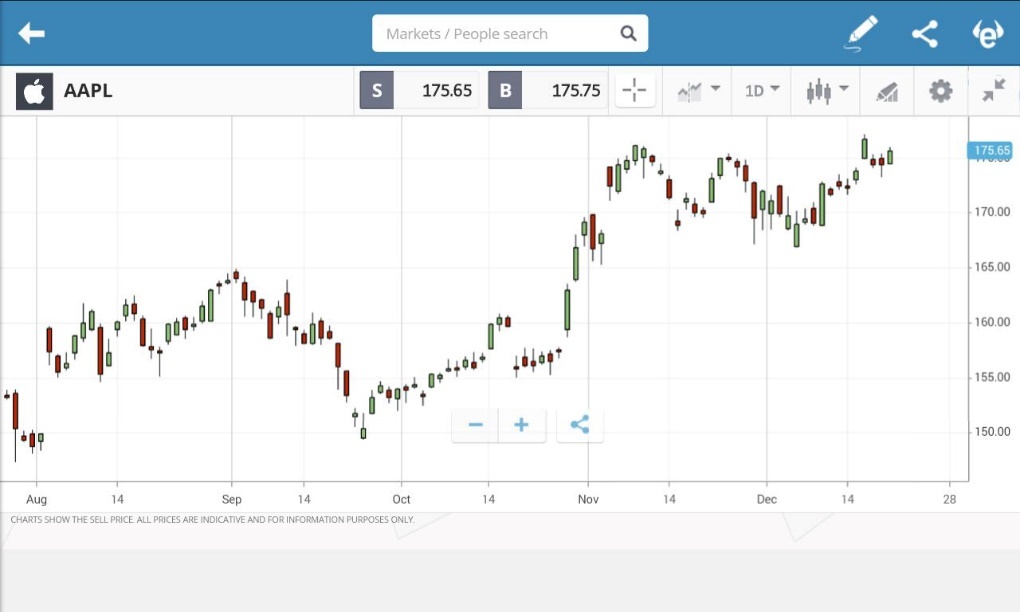

プラットフォームのナビゲーションは初心者にとっても経験を積んだトレーダーにとっても、単純かつ簡単なものとなっています。全取引商品はTrade Markets(市場で取引)タブで見付けることができ、小見出し(株式、通貨、ETFなど)別に並べられ、取引または検討したい特定商品を選択すると、ローソク足を見る、過去の価格データをチェック、 現在の状況と価格がどのような影響を受けているかなど特定商品の情報を入手など、複数のオプションが表示され、特に仮想通貨の場合は非常に有効な機能となっています。

全取引商品についている別のオプションは、eToroのプラットフォームにいる全トレーダーがニュース、情報、特定商品に関する考えを共有できるソーシャルフィードです。

Trading Platform(取引プラットフォーム)の次のタブが、Copy People (人をコピー)タブであり、ここから顧客はフォローしたい利益をあげているトレーダーを選ぶことができますが、次の時は他のユーザーの全活動をコピーするということになります。ここにあがるトレーダーは、リスクと利益の統計に基づきランキングされ、経験のないトレーダーが真にフォローすべきトレーダー情報を十分に得ることができます。顧客がフォローするトレーダーを選ぶと、フォローしているトレーダーのポートフォリオ情報にすぐにアクセスすることができ、月間成績、損益分析、そのトレーダーの現在の保有商品、そして最後にそのトレーダーのソーシャルフィード(eToroのコミュニティとの交流がわかります)など統計にアクセスできるようになります。

eToroに加わった最新機能が、「CryptoFunds」で、顧客は資金をコピーできるようになりました。 基本的に、商品のコレクションは一箇所にまとめられています。CryptoFundでは7つ主な仮想通貨が取り扱いされています。

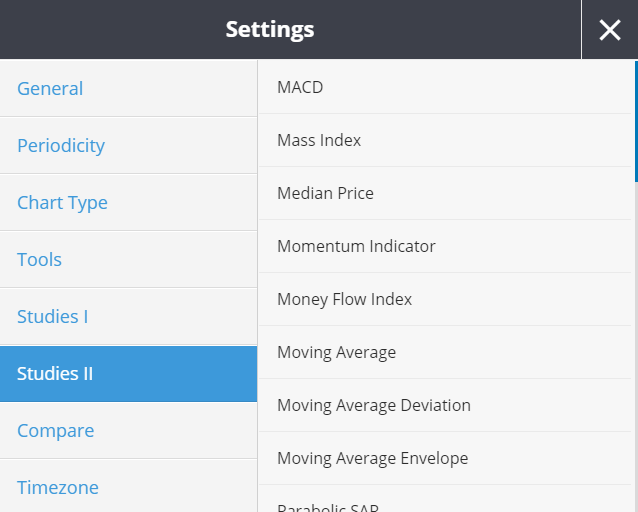

大事な点は、eToroプラットフォームには基本のチャート指標がすべてそろっているだけでなく、他の商品を重ねるオプションもあり、商品の相関関係を探そうとする者にとって、優れた追加機能となりそうです。残念ながら現時点では、独自のオーダーメード指標を追加するオプションはありません。たいへん残念です。

eToroのプラットフォームとチャート機能は初心者と経験を積んだトレーダーの両方のために設計されています。一見すると、見た目のよいプラットフォームではないかもしれませんが、構成がよく使いやすいものです。

執筆時点では、eToroは自動取引ソフトはサポートしていません。

eToro Mobileは使いやすいか?

eToroのWebサイトはあらゆるモバイル機器に対して最適化がされており、Webベースのプラットフォームを使って自由に取引もできます。また、Androidと iOS用モバイルアプリもありますが、Webベースとモバイル機器のアプリケーションの取引経験は同じです。

アプリとWebベースのプラットフォームは、チャート用スペースをまったくなくさずに、縦横の方向を切り替えることができます。

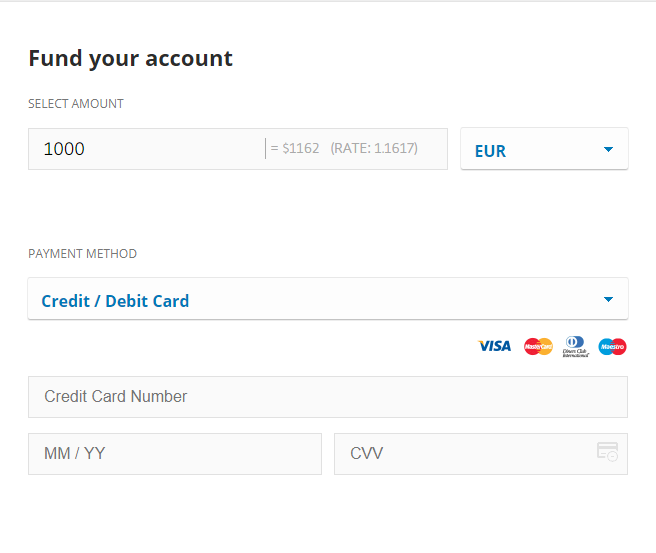

eToro 入金と出金

eToroへの入金は迅速かつシンプルです。すべての口座は米ドル建となっているため、他の通貨で入金が行われると、eToroでは入金通貨に応じて転換費用がかかります。

他のブローカーと異なり、eToroの最低入金額は1,000ドルであり、異例の高さとなっています。どの市場でも小売FXブローカーは最低入金額を5ドルに引き下げていることを考えると高いです。eToroが後れを取っているもう一つの点が、入金費用と出金費用を負担せず、顧客が費用を支払わなければならないという点です。

顧客は多数の支払い方法を使って入金できます。

- クレジットカード(Visa、Visaエレクトロン、マスターカード、Maestro)

- PayPal

- 電信送金

- UnionPay(銀聯)

- Neteller

- Skrill

- ウェブマネー

- Yandex

Instrument | Fee |

EUR USD | 250 pips |

GBP USD | 50 pips |

CAD USD | 250 pips |

JPY USD | 250 pips |

AUD USD | 100 pips |

RUB USD | 50 pips |

RMB USD | 50 pips |

出金の面では、eToroは成果をあげる方法をとっていません。転換費用は入金費用と同じですが、25ドルの「出金手続費用」が追加で発生して膨れ上がります。この出金手続き費用は他のブローカーではみたことがないものです。顧客が出金時にもう一度考えるようにしむける抑止力となっているのは明らかです。

最小出金額は50ドルで、eToroによると、出金処理にかかる時間は1営業日、顧客に資金が届くまでに最大5営業日です。しかし、多数の顧客は、出金処理はまった行われなかったか、資金を受け取るまで5日をはるかに上回る期間がかかったと述べています。

eToro カスタマーサポート

顧客には、10カ国語で電子メールチケットサービス経由でサポートが提供されています。このサービスでは、顧客が質問を提出して回答がくるのを待つのですが、ここでもやはり数日間かかることもあります。eToroは顧客にライブチャットも提供していますが、英語で週5日24時間利用できるだけです。

上にあげた以外に、eToroにh3つの電子メールアドレスがあり、顧客はPR、アフィリエートと事業開発について連絡を取ることができます。

ブローカーがすべての原語でライブチャットを提供しておらず、顧客がサポートを受けられる電話番号がないという事実から、eToroは優れたカスタマーサポートを提供していないことがわかります。これは非常に残念な点です。カスタマーサポートは初心者、上級者にかわりなく、あらゆるトレーダーが必要とする必須要素だからです。

eToro 研究と教育

一見したところ、eToroは、ライブのウェビナーとオンデマンドのウェビナーから、双方向取引コース、ついにはブログに至るまで、多数の教育オプションを備えているようです。しかしよく見ると、教育オプションは一見したほど広範ではないと気づくでしょう。たとえば、オンデマンドのウェビナーは合計7つの動画であり、1分から45分の長さであり、様々な取引と言語で提供されています。ブログは週1度か2度更新されており、この数ヶ月に投稿されたすべてのブログは仮想通貨に焦点を合わせたものでした。双方向取引コースは一つだけで、10言語で提供されており、初心者には価値があります。

研究サイドで見ると、eToroの取引プラットフォームは株式CFDに関する研究資源は提供していますが、リアル口座所有者しかアウセスできません。

注目すべき点

eToroによる人気投資家というコンセプトは非常に面白いもので、他のブローカーとの開発が始まるかもしれません。 簡単に言うと、トレーダーは様々な収入源を作りだし、取引だけではなく、他のトレーダーをコピーすることで、稼ぐことができます。このオプションを使って、eToroはすべての取引に対して、2%の運用手数料 と最大100%のスプレッドリベートを提供しています。言い換えると、大きなトラックレコードがついたすべてのトレーダーは、ファンドマネージャーのようなものになることができ、唯一の要件は、完全なプロファイル詳細がついたリアル口座だけとなります。

結論

eToroはおそらく、これほど多くの多用な取引商品を一箇所で提供している唯一のオンラインブローカーです。eToroプラットフォームは使いやすく、あらゆるコンピュータ、タブレット、スマートフォンからwebブラウザーを通じてアクセスできるため、初心者でも経験豊かなトレーダーでも、取引またはポートフォリオの管理ができる便利な方法となっています。

顧客がeToroの選出を検討するかもしれないもう一つの理由はeToroが提供するソーシャルトレーディング・システムです。取引方法を学ぶ楽しく興味をそそる方法であり、取引時間のない人にとっては、トレーダーを選出して、その取引をコピーするだけのよいオプションです。他人に自己資金の投資方法の決定権を与えるのはやはり用心することをお勧めします。取引の最善のアプローチは、しっかりとした教育基盤です。

私達が本当に好きになれないeToro最大のマイナス面は、入金と出金の処理方法です。最低入金額は1,000ドルと新米トレーダーにとって非常に高いものですが、多額の投資に携わる前にプラットフォームをテストするため、少額を預け入れたいと思う者にとっても高いものです。これに加えて、米ドルではない預入金はすべて、米ドルに転換され(転換の値上げを予想)、高額の入金費用も伴います。逆に、この数年の業界標準は、最低入金額はわずか5ドルで、入金にまつわるすべての取引費用はブローカーが負担しています。顧客も希望するベース通貨(ユーロ、米ドル、イギリスポンド、日本円)を選べるため、転換は必要ありません。

出金を見ると、25ドルの出金比が必要というのは、私たちの意見ではまったく倫理にもとるものです。実際、それが抑止力となって、顧客は出金しません。また、出金処理がされていないという不満を漏らすトレーダーがいるという事実は、心に留めておくべき問題でしょう。

また、提供されている高スプレッドも特に好ましいとは思っていません。この高スプレッドのために、スキャルピング戦略を採用するトレーダーに制限がかかることになりかねません。

ユーザーレビュー

3.9

に基づく 2 ratings

Recovery

If you fell victim for binary option scam , binance, IQ option fight back with a ultimate crypto inv.. Anyone can be scammed , it happens to the best of us but these scammers actually aren't smart at all and with the right connection you will get all of your money back. When I fell for IQ option's scam , I was devastated but I summoned strength and asked for help and I was fortunate enough to get help from hightechcoininvestment @ gmail com Whatsapp:+1(704)7690765. Join the ultimate crypto inv. today and learn from experience of investors like you.

serious?

How I got back my money

I finally got all my money back from these Binary options broker who almost took away $17000 from me, I remain grateful for a review I followed that helped with the process. I am willing to share the experience. [email protected]