What is Bitcoin Cash (BCH)?

by Trading 101 sie 03, 2019

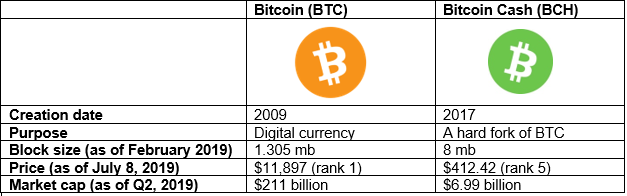

Bitcoin Cash (BCH) is very young - so young in fact that it was only born on August 1, 2017. Its older brother, good old regular Bitcoin (BTC), is several years old already. Everyone knows by now that Bitcoin (BTC) is probably the best investment you can make when it comes to cryptocurrency. It has been the strongest and most profitable cryptocurrency on the market since it was first released in 2009. So you may find yourself wondering – where did Bitcoin Cash come from and why is it a thing? Is it going the same path of success as its parent currency Bitcoin? Or is it seen as just another failing altcoin (alternative coin)? And what do you need to know to round out your bitcoin Trading 101 knowledge?

‘Fork’ briefly explained

The first thing to understand is what a fork is in for blockchain technology. It’s quite simple - a fork is a result of a change in protocol in a cryptocurrency leger that some nodes in the network follow, while others didn’t. This is often the result of protocol updates or software updates and if some nodes didn’t update their software, they’ll follow along the fork.

Here’s an example: if you have a total of 100 nodes in the network and publish a security update to your protocol, there’s a chance that only 80 nodes update their software to match your new protocol. Those 80 are now following the new rules, but the 20 that were offline for some reason or didn’t receive the update, are now still following the old rules, creating two different blockchains essentially. This knowledge of how blockchain works is essential and can theoretically happen again, making large waves in the crypto markets, so add that to your Trading 101 notes.

Bitcoin Cash (BCH) is the result of a fork

Bitcoin Cash (BCH) is a clean break from regular Bitcoin (BTC) and can be considered an offshoot from the original Bitcoin. It identifies itself as “a peer-to-peer electronic cash for the Internet” and touts that it has a set of improved rules that are meant to allow the currency to grow and scale. It claims itself to be the “continuation of the Bitcoin project as peer-to-peer digital cash.” The creation of Bitcoin Cash was rather accidental, and it was announced that Bitcoin owners as of a certain block are now also Bitcoin Cash owners. Each original Bitcoin owner at that time gets a Bitcoin Cash equivalent to the amount of Bitcoins they were holding at the time of the forking.

Trouble in paradise?

These changes and the initial split of BCH from BTC has brought a lot of discussion to the cryptocurrency communities. Bitcoin now has 16.5 million units that are being distributed, and Bitcoin Cash has 16.5 million units as well. Bitcoin Cash has actually already reached a market cap of $10.8 billion within its one month of life (in 2017), enjoying its position as third on the list of most profitable cryptocurrencies. Bitcoin of course tops this list with its $69 billion market cap (Q3, 2017; $205 billion as of Q2 2019).

The forking also highlighted one of the main problems with Bitcoin which has been in debate from the community for over a year now - the size of Bitcoin’s blockchain blocks. In Bitcoin’s code, each block can be as large as 1 MB of data, which amounts to 3 transactions per second, which many call as too small for its current scale of transactions.

Improved block size capacity

A rather large benefit of Bitcoin Cash is the fact that it includes improved block size capacity. As soon as Bitcoin Cash hit the market, miners noticed the significantly faster pace at which new blocks were created. This is called the hash rate. The hash rate attracts not only miners, but investors as well, because the more blocks, the more mining possibilities, and the more mining possibilities, the more coins that may be discovered.

Bitcoin Cash was also created with the intention to speed up transactions and processing times. While Bitcoin can complete a maximum of 6 or 7 transactions per second, Visa and PayPal are able to complete 2,000 at the very least. Bitcoin Cash was hoped to help this issue by enlarging block sizes from a measly 1MB to 8MB.

This would allow for the processing times of transactions to be substantially improved. However, in order for such large block sizes to function, a large amount of professional software is required, and this may lead to the cryptocurrency becoming centralized. To centralize Bitcoin Cash would mean to take away its greatest benefit as a cryptocurrency. For this reason, Bitcoin Cash is facing some difficulty.

The aftermath

Bitcoin has committed to implementing an upgrade called SegWit, which will allow for larger blocks, which has plenty of pros and cons. Bitcoin Cash did not agree with the shift, and instead increased its own block size to 8 MB of data.

In the aftermath of the fork in 2017, Bitcoin lost some market share, going down to 44.7%. Ethereum on the other hand witnessed an increase of demand, raising its value above $220, right while Bitcoin Cash became the third largest currency around, trading at $400 per token levels, pushing Ripple into the number two slot for a while. Within a few hours of reaching $400 per token, the market started moving and the interest in Bitcoin Cash grew further, moving it to $700 levels per token and an increased market capitalization of almost 11% while regular Bitcoin dropped down to 43.3% instead.

A summary of its differences