Understanding Japanese Candlesticks: Morning and Evening Stars

From the same category as the hammer and shooting star, the morning and evening stars are reversal patterns that appear often. A three-candle pattern, the morning and evening stars form at the end of a trend and provide impressive Forex trading setups.

As the name suggests, a morning star shows bullish conditions. It appears at the end of a bearish trend, and traders expect the market will bounce.

On the other hand, an evening star forms at the end of bullish trends. Traders want to go short after an evening star, as the market becomes bearish.

Therefore, the morning star appears in the same place as the hammer, while the evening star has the same conditions as the shooting star. The difference between the patterns comes from the number of candles: one candle in the case of the hammer and shooting star, and three candles in the case of a morning and evening star.

Conditions for the Morning and Evening Stars Patterns

Because a morning star forms at the end of a bearish trend, that’s the first prerequisite: a bearish trend must exist. Hence, the first candle in the morning star formation is bearish, having a big, red, real body.

The second candle is either a Doji (has the same opening and closing prices), a hammer or a simple candle with a small or insignificant real body. The color of the real body doesn’t matter; it can be either green or red, the morning star won’t depend on it.

Finally, the third candle is the one that holds the key to the pattern. Because the morning star is a bullish pattern, this candle shows the potential reversal.

Therefore, it has a strong, green real body, which extends more than fifty percent into the first candle’s territory. Most of the time, it exceeds the length of the first candle in the pattern by far.

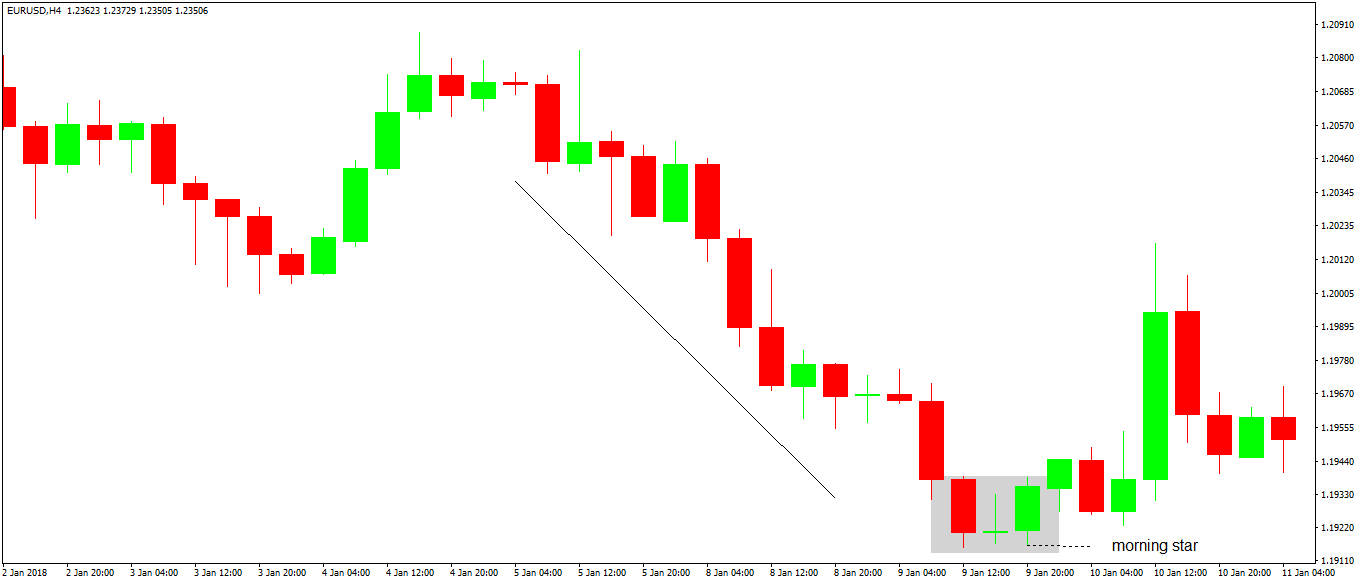

The chart above shows a bearish trend. The market keeps falling, and nothing indicates the possibility of a reversal anytime soon.

However, after a strong, red, bearish candle, the market forms a candle with a small real body. Typically, such candles show hesitation, uncertainty.

Bears hesitate, and bulls prospect the opportunity. It is now when the focus shifts to the third candle.

In this case, the third candle closes well beyond the fifty percent distance of the first candle, giving the bulls the green light: a reversal pattern is in place. When the candle in the middle is a Doji or a hammer, the pattern is even more powerful.

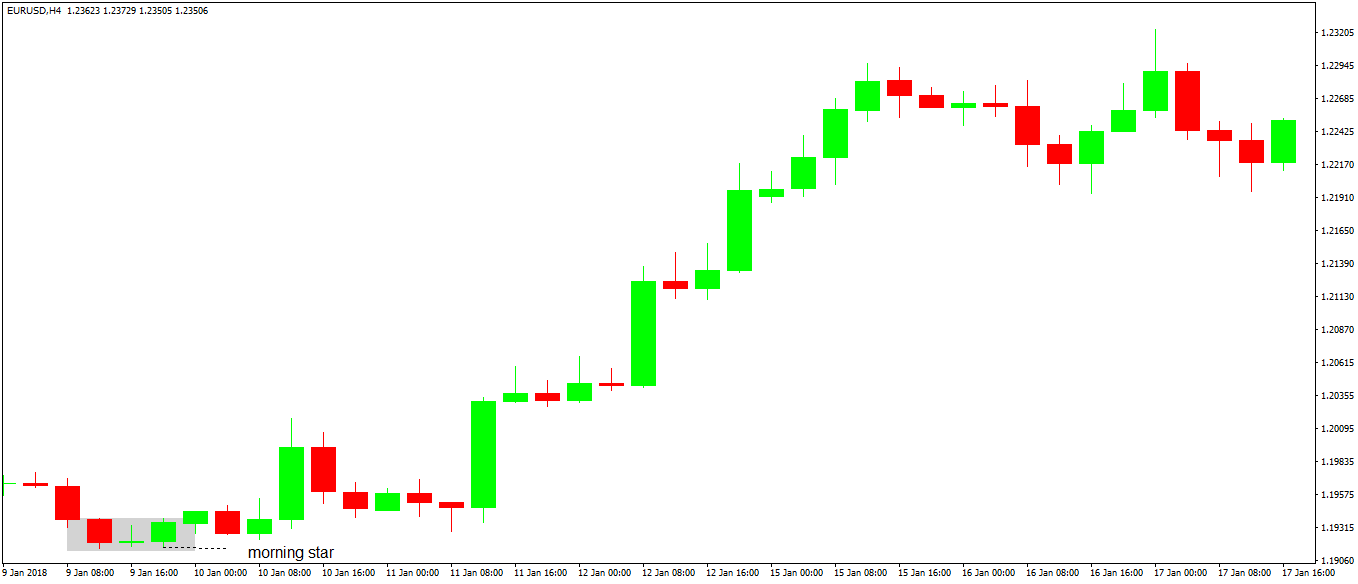

Here’s what followed:

Not only did the market bounce, but a bullish trend started right after the morning star formation.

For the evening star, the market needs similar conditions, only the other way around:

- A strong, bullish trend must exist

- The first candle has a significant real body, a green one

- The candle in the middle is either a Doji, a candle with a small real body or a shooting star

- The third candle is a bearish one and travels over fifty percent into the first candle’s territory.

With that in mind, let’s see how to integrate these powerful reversal patterns into a money management system suitable for Forex trading.

How to Trade the Morning and Evening Stars Patterns

In Forex trading, any trade must have a stop loss and a take profit. They are the pillar of a money management system that deals with assessing risk and increasing the probabilities of making a profit.

The stop loss represents the invalidation of a trading scenario or setup. If the market moves beyond it, the trader takes the loss.

In some cases, traders don’t place the stop loss and have one “mental” stop. Namely, when and if the market moves beyond a specific level, traders will close the position.

While this sounds like a plan, in reality, the market plays tricks on traders. Sometimes it moves so fast that one can’t close the trade manually soon enough to limit the losses.

But the market is not the only thing that plays a trick on traders, human nature too. Hope, greed, and fear make traders make the wrong decisions.

As such, why not use a stop loss? It shows a trading plan is in place and it is an integer part of a Forex trading strategy.

For the morning and evening star, the stop loss is the minimum/maximum value in the pattern. It doesn’t matter what candle makes the low or the high.

Any reversal pattern shows a battle between bulls and bears. For this reason, bears won’t give up easily after the morning star formation, nor bulls after an evenings star pattern.

Therefore, look for a pullback before deciding to go long or short. Depending on the timeframe the pattern forms on, traders use either entry at the market or place a pending order.

Typically, the market retraces between 50% and 61.8% of the star, before the previous trend reverses. If the star forms on the hourly timeframe, most likely traders enter at the market, but if a more significant timeframe like daily or weekly/monthly sees a star formation, it makes sense to place a pending order as it may take quite some time until the pullback comes.

For a morning star, traders place a pending buy limit order. A Forex trading plan for a morning star follows these steps:

- Measure the highest and the lowest point in the morning star using the Fibonacci retracement tool

- Place a pending buy limit order at 50%-61.8%

- Put a stop loss at the lowest point of the morning star

- Put a take profit corresponding to a 1:2 or 1:3 risk-reward ratio

Aggressive traders choose to chase the market even higher. They use a trailing stop after the market bounces, with the idea of riding the newly born trend as long as possible.

For an evening star, traders place a pending sell limit order. A Forex trading plan for an evening star follows these steps:

- Measure the highest and the lowest point in the morning star using the Fibonacci retracement tool

- Place a pending sell limit order at 50%-61.8%

- Put a stop loss at the highest point of the evening star

- Put a take profit corresponding to a 1:2 or 1:3 risk-reward ratio

Conclusion

The bigger the timeframe the stars form on, the more powerful the reversal potential and the bigger the opportunities. But stars won’t reverse a trend all the time.

For this reason, the use of a stop loss is mandatory and essential. It is important because if the market moves below/above it, it merely invalidates the pattern like it didn’t exist.

Influential stars have a hammer or a Doji candle in the middle. Following the rules of trading, a hammer makes sense too, only that the market may not retrace to generate the hammer-related trade.

As for the Doji candle, it is one of the most mysterious patterns of all Japanese approach. It shows both continuation and reversal conditions, and we’ll cover the concept with an entire article dedicated to it.

Like in the case of a hammer and shooting star, trading morning and evening stars avoids the usual emotional rollercoaster. Fundamental traders (Forex trading based on news interpretation) always end up questioning themselves. They are left wondering, what if the market reverses? What if they’re wrong? As most of their analysis is simply their own interpretation of the economic news.

Technical traders, on the other hand, use precise rules to enter and exit a market. No matter what the reason is, if the market formed a reversal pattern, they know the way to trade it, and don’t care about the reason behind the market reversal.

Such consistency and discipline lead to the trading account growing and to traders being successful in Forex trading.