Elliott Waves Theory: What is an Impulsive Wave

After discussing the basics of the Elliott Waves Theory in a previous article, it is time to have a more in-depth look at its application in Forex trading. Elliott claimed the theory follows human sentiments of greed and fear and that the market’s behavior can be predicted.

The waves theory considers various cycles of different degrees that integrate both an impulsive and a corrective wave. The degrees are easy to identify using the timeframes that exist on any trading platform. As such, an Elliott Waves count on the monthly chart shows a bigger cycle analysis than one of the four-hour or the hourly timeframe.

Elliott divided the waves or the moves the market makes into impulsive and corrective. For a straightforward interpretation, he used numbers to illustrate an impulsive activity, and letters to show corrections.

For this reason, any discussion regarding an impulsive wave starts with the numbers involved: 1-2-3-4-5. According to the theory, an impulsive move has no more, no less than five waves.

Rules of an Impulsive Wave

For a market move to be impulsive, it must obey the following rules:

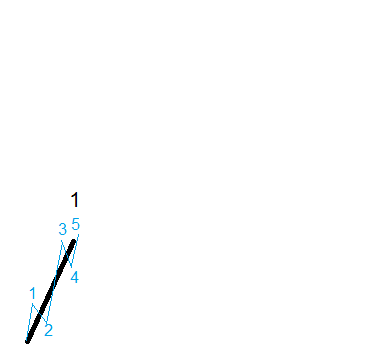

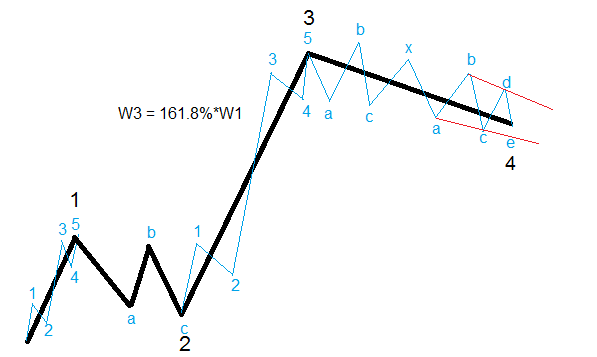

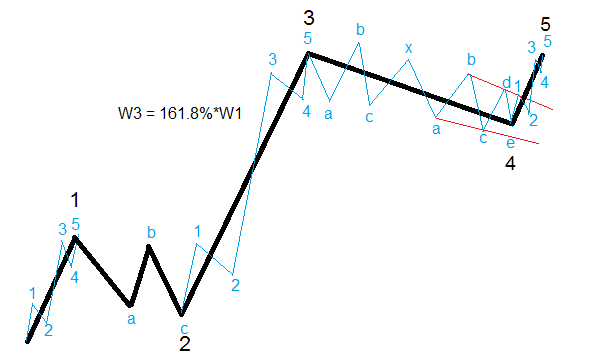

- The 1st wave in any impulsive move is an impulsive wave itself. It means that the first wave has another 1-2-3-4-5 of a lower degree, and so on, with the market dividing itself into micro waves.

Naturally, the 1st wave in blue belongs to the impulsive wave of a lower degree. Moreover, it has a five-wave structure too, visible on a lower timeframe.

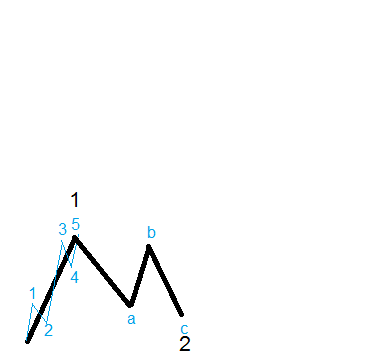

2. The 2nd wave of any impulsive move is corrective. Hence, traders will use letters to count it, and the correction may be either simple (zigzag, flat, triangle) or complex (one or two intervening x-waves connect two or three simple corrections).

In this case, the second wave is a simple correction, a so-called flat pattern, labeled a-b-c.

3. No parts of the second wave should exceed the start of the five-wave structure. This is an essential rule in Forex trading because that’s the absolute stop loss level for a trade based on the 2nd wave’s retracement.

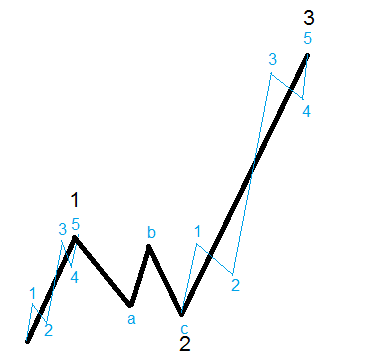

4. The 3rd wave is an impulsive wave too. Hence, traders label it with 1-2-3-4-5 of a lower degree.

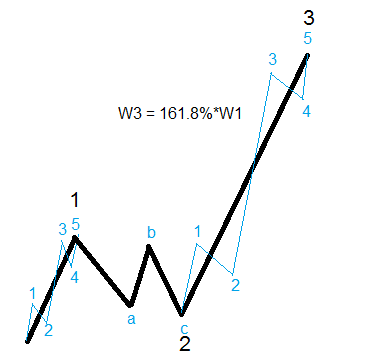

5. Every impulsive wave must have at least one wave that extends. The rule for the extended wave calls for it to be longer than 161.8% of the previous impulsive wave. Most of the times the extension applies to the 3rd wave, so it needs to be longer than 161.8% of the 1st wave.

In this case, the extension leads to a potential trade. As you know by now, a Forex trading setup must have an entry, a stop loss, and a take profit.

For a bullish impulsive wave like the one shown above, traders:

- Measure the 1st wave’s length using the Fibonacci retracement tool

- Find the 50%-61.8% retracement level, and go long

- Set the stop loss at the start of the 1st wave

- Set the take profit at 161.8% of the 1st wave, projected from the end of the 2nd wave.

The extension is the minimum distance the market must go. Strong impulsive waves see even levels like 261.8% or more for the extended wave.

- The 3rd wave cannot be the shortest wave when compared with the other impulsive waves in the structure.

- The 4th wave in any impulsive wave is a corrective structure. Just like the 2nd wave, it is either a simple or a complex correction. As a hint, traders look at the 2nd and 4th waves to alternate. Therefore, if the 2nd wave is a complex correction, the 4th will most likely be simple, and vice versa.

In this case, the 4th wave is a complex correction (indicated by the x-wave), a so-called double combination that corrects the previous 3rd wave.

- The 5th wave of any impulsive move must show impulsive activity too. Moreover, most of the times it exceeds the end of the previous 3rd wave.

This is how an impulsive wave or a five-wave structure with the Elliott Waves Theory looks like. Not that simple anymore, is it?

Now you understand why the theory only looks like a simplistic approach, whereas in reality is one of the most complex ever created. Various trading strategies with the Elliott Waves Theory lead to multiple scenarios for the same market.

For example, some traders choose to trade only the 2nd wave retracement, as explained earlier. Because the 3rd wave is the most likely wave to expand, they hunt the extension, and that’s it.

Some other traders feel more comfortable trading corrective waves. Because the market spends most of the times in consolidation areas, or corrective waves, that’s what traders want to master.

Check the chart above and compare the time taken for the corrective and impulsive waves in a five-wave structure. You’ll notice that the two corrective waves (the 2nd and the 4th waves) take more time to form than the three impulsive ones.

Types of Impulsive Waves

Based on the extended wave, there are three main types of impulsive waves:

- 3rd wave extension. The example used in this article is a 3rd wave extension impulsive move. It merely means that the 3rd wave is the longest wave and its minimum distance must exceed 161.8% of the 1st wave’s length.

- 1st wave extension. When the 1st wave is the longest one, it must extend more than 161.8% of the 3rd wave’s length. If that’s the case, look for the 2nd wave to be the most time-consuming.

- -5th wave extension. A somewhat rare possibility, the 5th wave extension sees the 5th wave extending more than 161.8% of the previous 3rd wave’s length.

Sometimes the market may form a double extended impulsive wave, meaning both the 3rd and the 5th waves respect the extension rule. But in reality, it is nothing but a 5th wave extension that has a longer 3rd wave.

Conclusion

An impulsive wave is one of the two pillars of the Elliott Waves Theory. Elliott divided the moves a market makes into impulsive and corrective waves.

Therefore, this is the first question to answer when starting to count a currency pair. Both impulsive and corrective waves form an Elliott Waves cycle, crucial in any Forex trading Elliott analysis.

A five-wave structure, the impulsive move forms both in bullish and bearish trends. When the market advances or declines, most likely it’ll do that in an impulsive structure.

The most common impulsive wave has the 3rd wave the longest in the structure. About eighty percent of impulsive waves have the 3rd wave as the longest one, while the rest belongs almost entirely to the 1st wave extension.

A 5th wave extension is a rare pattern in Forex trading. There are so many rules and particularities of it, that chances are very slim to see it on a currency pair count.

But all these rules discussed here have no meaning if one doesn’t understand the cycles and how they form. Historical data play a crucial role because it allows traders to count from a top/down perspective, starting with the biggest possible timeframe and ending with the lowest one.

Lower than the hourly timeframe, the Elliott Waves Theory tends to lose its significance. Because counting waves is a time-consuming process, having to check all the rules for an impulsive or corrective wave, traders end up missing the market moves if they focus on the lower timeframes.

To sum up, impulsive waves form often, and they offer fantastic opportunities in Forex trading. If the market advances or declines, it’ll do that in a five-wave structure.