Volume-Based Strategies in the Currency Market

Perhaps no other technical concept sparked traders imagination than the volume of a financial market. Many traders look at the volume in Forex trading too, following trading techniques destined to show the “right side of the market.”

By the right side of the market, traders refer to the “smart money” or the “big players.” Retail traders know or should know that their influence in Forex trading is minimal. The changes in prices due to retail buying or selling is so small; it isn’t worth the trouble of analyzing it.

Statistically, less than six percent of the entire Forex trading volume belongs to retail traders. Yes, if all retail traders in the world would buy or sell something at the same time, the impact on Forex trading would be insignificant.

Other market participants account for much more than six percent. Think of:

- central banks (they have trading departments to implement monetary policy changes and to intervene in markets when needed directly)

- commercial banks (they all have at least one treasury department to buy and sell currencies on behalf of their clients)

- Forex brokers (depending on the type of the brokerage house, Forex brokers may trade on their own or against their own clients’ positions)

- high-frequency trading (responsible for a massive chunk of daily transactions, the HFT industry can move the prices in a blink of an eye)

- mergers and acquisitions (when a U.S. based company, for example, buys a European one, the payment will be made in Euros; someone needs to buy those Euros, with the company hiring a consortium of different banks to do the task through their treasury departments)

- liquidity providers

- investment houses

- hedge funds

- boutique family offices for high-net-worth individuals

The list, as you can imagine, can go on and on, until reaching the retail traders. So, no, it isn’t a fair game for the retail traders, as all those entities mentioned above:

- have more significant capital to trade with

- research departments to help in trading decisions

- the means to face a sustained period of being on the wrong side of the market

Hence, it is the best representation of what the “smart money” is or who represent the “big players.

Volume in Forex Trading

Inspired by the stock market trading strategies where the volume plays an important role in spotting the “big players” positioning, retail traders use similar approaches in Forex trading.

The intention is noteworthy, but it faces an existential problem. In the stock market, one can quantify the volume by dividing the trading amount to the price/share. Hence, trades find the number of shares traded.

Next, with the number of outstanding shares known, they estimate the traded volume’s size in the entire market capitalization of a respective company. Finally, they evaluate the impact that the volume has on each period on any given chart.

We can’t say the same in Forex trading. Despite Forex trading platforms offering plenty of volume-based trading indicators, traders must know one thing: the volume refers ONLY to the transactions made through that respective broker.

While they may offer an idea about the average volume traded at any given point in time, they represent nothing but an idea! Because the market is so big, it is impossible to quantify the volume at any one moment of time during the trading day, week, month, and so on.

Hence, using volume-based strategies would be nothing but an educated guess, far away from what the volume strategies in the stock market show.

Despite that, Forex traders still look for the volume to provide that edge, that competitive advantage ahead of other market participants. Either not knowing or not believing what the volume shows in Forex trading, they use the same principles as on other markets.

To be entirely fair, sometimes it works. Great trades may result using such analysis, but again, the result is random, not the outcome of a volume-based strategy.

By now, you probably got the point that this article won’t deal with explaining volume-based strategies in Forex trading. Instead, it deals with defining the volume and why traders need a distinct approach to Forex trading.

Volume-Based Indicators in Forex Trading

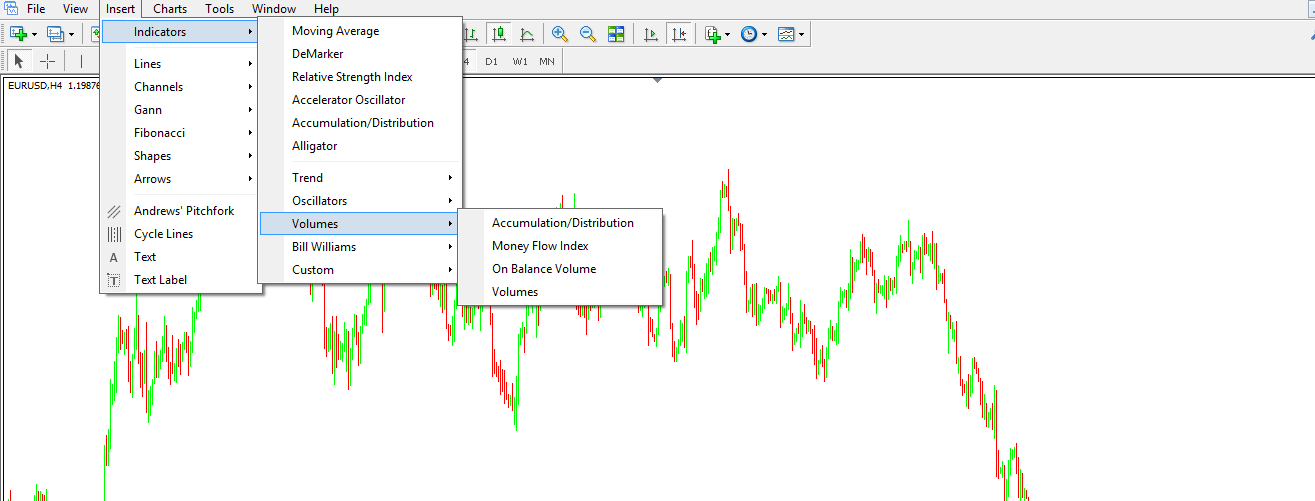

Forex brokers do offer plenty of trading indicators that show the volume of any given period. Here’s a list of the volume-based indicators provided with the default settings of any MT4 platform:

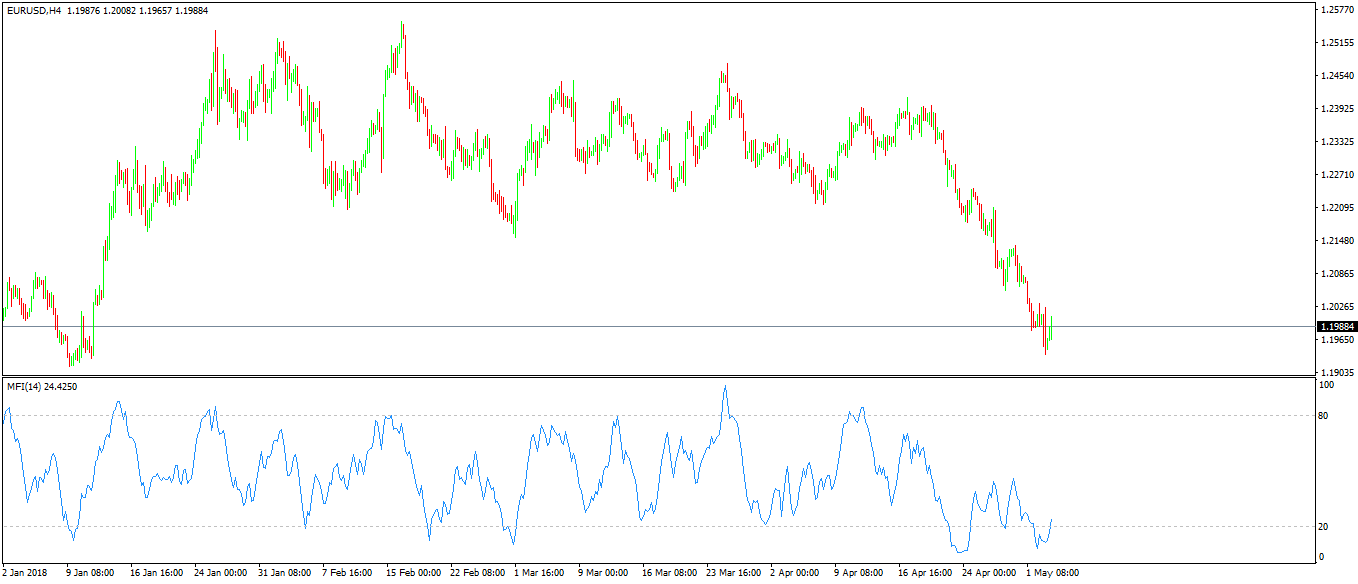

Money Flow Index in Forex Trading

The first one from the list above, the money flow index is an interesting concept. As a combination of price and volume, this oscillator is also known as a volume-weighted RSI.

For this reason, it travels between zero and one hundred (thus having only positive values) and the 80 and 20 levels are the extreme ones. The interpretation is like the one used when trading with the RSI: buying and selling in oversold and overbought levels and taking advantage of bullish and bearish divergences.

Accumulation/Distribution

One of the most famous volume-based trading techniques is the VSA (Volume Spread Analysis). A fantastic method, it aims to spot when the “smart money” is slowly accumulating before the market starts a bullish or bearish trend.

Then, it focuses on the distribution phase, when “smart money” gets out and “distributes” to the retail traders and other parties interested in taking the other side of the trade.

On Balance Volume (OBV)

The OBV offers another interesting idea of using volume. It claims to spot the areas where significant increases in the volume traded don’t affect the price.

Or, it shows the earlier accumulation and distribution phases part of the VSA strategy.

Volumes

The Volumes indicator merely shows the number of contracts/lots traded at any given period on a chart. It is irrelevant as irrelevant can be in Forex trading.

Conclusion

Volume-based analysis works excellently when conditions exist to quantify the volume of a market. However, it is impossible to do it timely on any currency pair.

Thus, any volume-based strategy is a relative interpretation of the moves in a currency pair. Again, not that they won’t work, but they won’t work as they are supposed to work in other markets when the volume is known.

Supply and demand in Forex trading is only a guess. Not a certainty. For this reason, the volume is difficult to use as it is supposed to spot imbalances between the two.

The volume-based indicators mentioned in this article are only some that come with the default settings on the MT4 platform. Other similar indicators exist, that can be imported to a MetaTrader4 platform. Moreover, some other trading platforms offer an impressive range of volume-based indicators to use.

However, they do offer other markets to trade, where volume-based analysis makes sense. Hence, a trader must know what and when to use them.

Of everything presented in this article, if there’s one volume-based strategy to master, focus on the VSA (Volume Spread Analysis). It goes back in time, having some great features when it comes to forecasting a price, and plenty of examples exist to document it.

Again, just don’t use it in Forex trading, as results are always subjective, rather than objective.