How to Trade Rising and Falling Windows

Part of the Japanese approach to technical analysis, windows are continuation patterns. The Japanese technicians have a saying that the market often takes its time to rest.

That’s the perfect illustration of what a continuation pattern is. The market trends, then suddenly stops for a while and builds energy to continue the dominant trend.

So far, we discussed the most important Japanese candlestick patterns and how to trade them. We looked at concepts like the hammer, the Doji candle, the bullish and bearish engulfing, piercing and dark-cloud cover, and so on.

Surprisingly, most of them were reversal patterns, with only the Doji candle showing the potential of the price continuing in the same direction. Windows come to balance the Japanese patterns, bringing the power of continuation patterns back into focus.

As we already mentioned in previous articles part of this trading academy, there is a Western and a Japanese approach to technical analysis. The comparison between the two reveals a tremendous advantage for the Japanese patterns, for the simple reason that they take less time to form and provide generous risk-reward ratios. In Forex trading, that is all traders look for.

The comparison continues with windows too. In the Western approach, the gaps represent the equivalent of the window concept from the Japanese approach to Forex trading. However, the interpretation is sharply different.

Gaps in Forex Trading

Gaps belong to the Western approach and have their roots in the classic technical analysis patterns in the United States. More precisely, a gap is not a pattern, but the interpretation of a gap became one.

Because most of the technical analysis concepts we know today come from the United States stock market’s analysis, it is no wonder that gaps come from that area too. In fact, gaps are so common on the stock market that one wonders why they built a trading strategy on patterns that appear so frequently.

Still, in time, the stock market’s analysis changed too. Futures came to complement the cash market, and now the stock indices trade in a continuous matter. It means that gaps still form, but not so often anymore.

The standard interpretation, or the Western approach to a gap, valid in Forex trading too, is that it must be closed. But before going into more details, let’s define what a gap is and what are its particularities in Forex trading.

A gap is the empty space, if any, between two consecutive bars or candlesticks. In other words, a bar or candlestick closes at one price, and the next one opens at a different one (bigger or smaller).

In Forex trading, gaps occur only over the weekend. Because the currency market is so liquid (trillions of dollars change hands every day), no move can cause a situation so drastic that the prices would differ so much.

Hence, if we are to see a gap in Forex trading, chances are it’ll formed on the Monday’s market opening.

Sometimes, over the weekend, unpredictable things happen. Fundamental analysis, as we know it, doesn’t mean only the economic news part of the economic calendar. Those are released during the regular Forex market hours.

Instead, political events like referendums and elections, or even some other events challenging to a forecast, take markets by surprise and they “gap” at the opening.

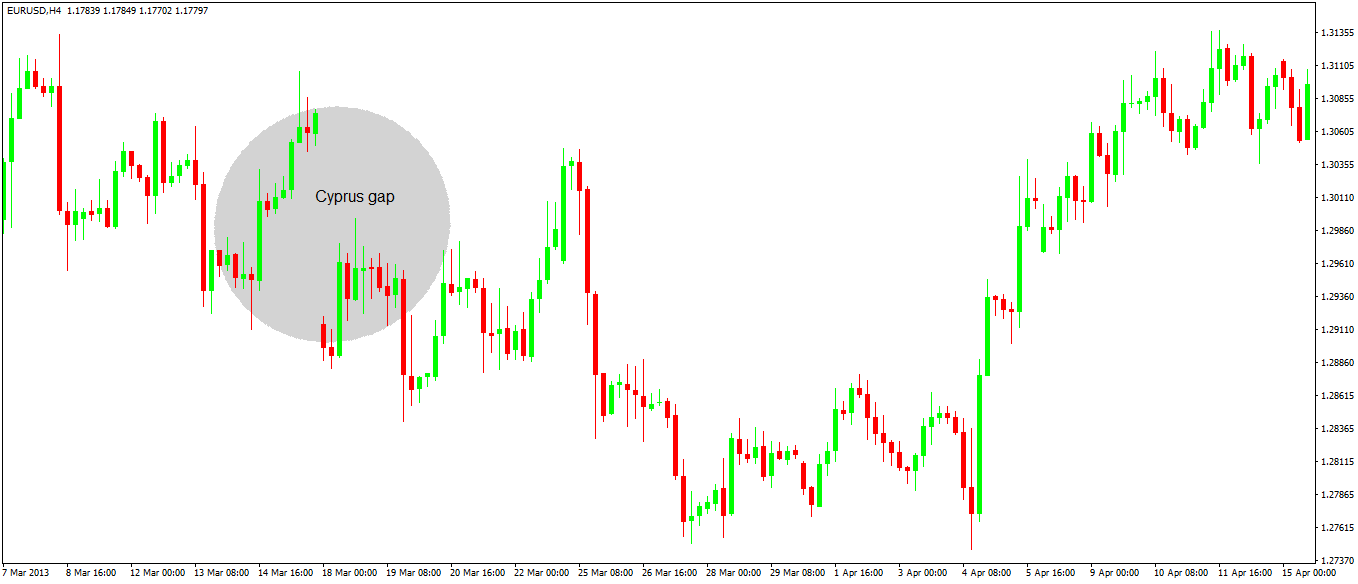

Here’s one of the most famous gaps in the recent Forex trading history. The one below belongs to the EURUSD pair, but all the Euro pairs witnessed a similar one. It remained in history as the Cyprus gaps, because over the weekend the Cyprus government, under the ECB (European Central Bank)’s supervision, decided to confiscate some of the deposits in the Cyprus banks. Hence, the market was spooked, and the gaps affected the Monday’s opening.

Gaps Interpretation

A gap, therefore, is the empty space or the void between the Friday’s closing prices and the Monday’s opening ones. At least, that’s the definition in forex trading, from the Western or classic technical analysis approach.

The standard interpretation, still used by many traders, calls for the market to close the gap. Or, no gaps should remain open.

However, there’s no logical argument behind it, despite some traders trying to document many Forex gaps and apply different rules. For example such a rule might state, a gap should close during the same trading day, or else traders should ignore it.

Or, it should close by the next Friday’s closing or the traders should ignore it.

In any case, Forex trading is full of gaps that remained open for quite some time, with the market traveling for thousands of pips and for some years, before turning and closing the gap. Hence, the market may stay irrational more than a trader remains solvent, making trading the classic interpretation of a gap a challenging one to use.

Windows – A Japanese Approach to Gaps

The Japanese come with a different approach. In Japanese technical analysis, gaps are called windows.

And, windows are a continuation pattern. Hence, the market should continue in the same direction as the trend before the window’s appearance.

Moreover, the Japanese approach offers something to use further in time. The window’s edges will provide firm support and resistance levels from that moment on.

Furthermore, a rule of thumb says that the bigger the window, the stronger the support and resistance level will be for the future price action.

Even the window’s definition differs. If, for example, the classic gap is measured from the Friday’s closing price until the Monday’s opening one, windows vary.

To measure a window (hence, to find the window’s edges), traders must effectively measure the opening space between the Friday’s and Monday’s candles.

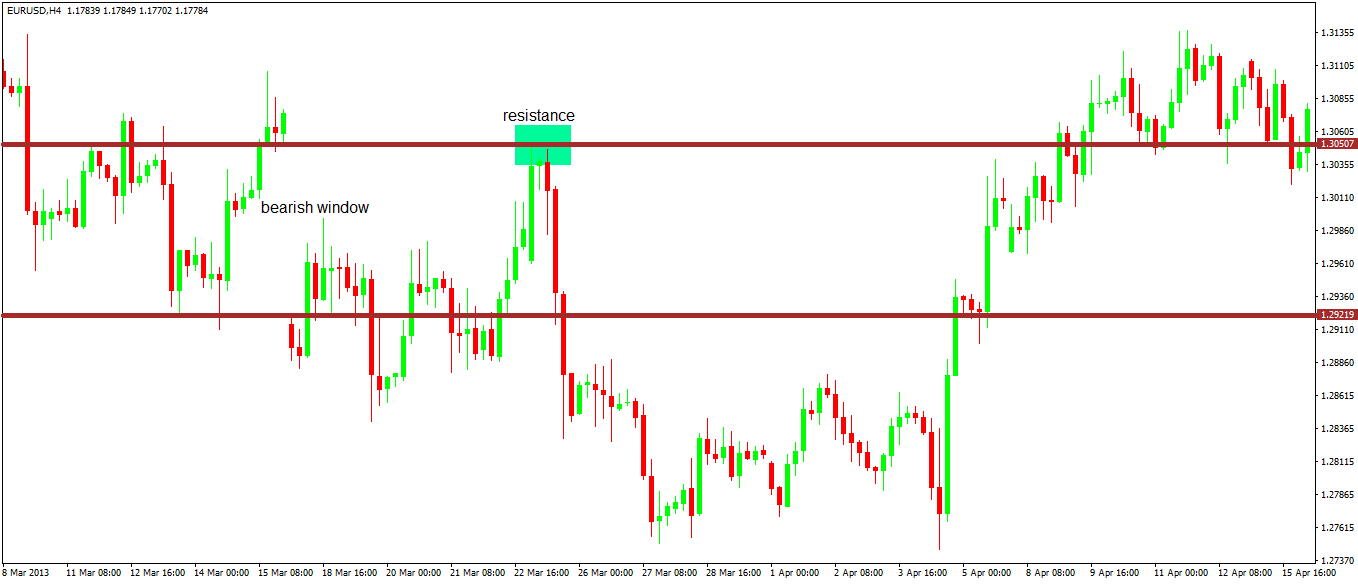

In the case of the Cyprus gap illustrated earlier, here’s how the Japanese would mark its edges:

Not only that the window has different levels than the gap, but its interpretation differs too. First, as we can see in the chart above, it does continue the previous trend, as the market makes a series of lows before bottoming and putting a double bottom as a reversal pattern.

Secondly, at the first attempt higher when the market bounced, it reached the opposite side of the window, and it was strongly rejected being sent to new lows.

Conclusion

Traders must pay considerable attention when trading and interpreting windows or gaps. Because in Forex trading they form mostly over the weekend, the prices on Monday’s opening differ from broker to broker.

Recent years saw brokers trying to get rid of the Sunday candle. For various reasons, either because of moving servers in different parts of the world or for merely offering a simple chart to avoid liquidity traps, brokers removed the Sunday candle.

However, trading takes place in New Zealand for a few hours on Sundays when the markets open. Hence, traders must have the real opening prices to use when trading windows.

To sum up, windows are just another interpretation of the classic gaps, but with multiple uses. They act as a continuation pattern and also offer support and resistance levels from that moment on.

Moreover, the bigger the timeframe, the stronger the support and resistance provided by the window’s edges.