How to Plan the Perfect Trading Week

Planning is part of any successful business or economy. Corporations plan their budgets well in advance for the next period. Governments do the same with the economic budget for the year ahead, and families plan their expenses and incomes too.

Why would Forex trading be different? The answer is that it shouldn’t, and this tells much about the importance of planning as part of a sound money management system.

The reason we discuss planning is due to the retail traders’ nature. Rarely do retail traders invest in a currency or currency pair, meaning that most likely they’re involved in scalping or swing trading.

More precisely, the time for keeping positions open vary from a few minutes to a few hours or maybe days. Rarely weeks.

The leading cause of this is lack of Forex trading experience and the fear of losing the capital. If we probe statistics, retail traders have plenty of reasons to act this way: the daily Forex trading turnover belonging to the retail traders is only about six percent.

Hence, the fear of not understanding what’s going on the bigger picture makes retail traders settle for the “hit and run” approach.

Not saying here that the approach is wrong, just acknowledging the reality. For this reason, and to avoid unnecessary costs that appear in the trading account for keeping positions for longer, planning weekly trading makes sense.

Focus on the U.S. Dollar

Once again, the focus is on the U.S. Dollar. As the world’s reserve currency is responsible for much of the Forex trading volume.

Add to this the fact that most of the economic news capable of moving the market comes from the United States. Because the Federal Reserve of the United States (Fed) has a dual mandate (it considers both inflation and jobs creation before deciding on the federal funds rate), there’s more economic data out of U.S. potentially moving the market.

Therefore, the plan for the trading week ahead starts with a quick look at the economic calendar. Traders filter essential news and adjust the trading strategies accordingly.

For example, let’s consider the Non-Farm Payrolls (NFP) release. It comes out every Friday of the month, and almost always the NFP week is characterized by tight ranges.

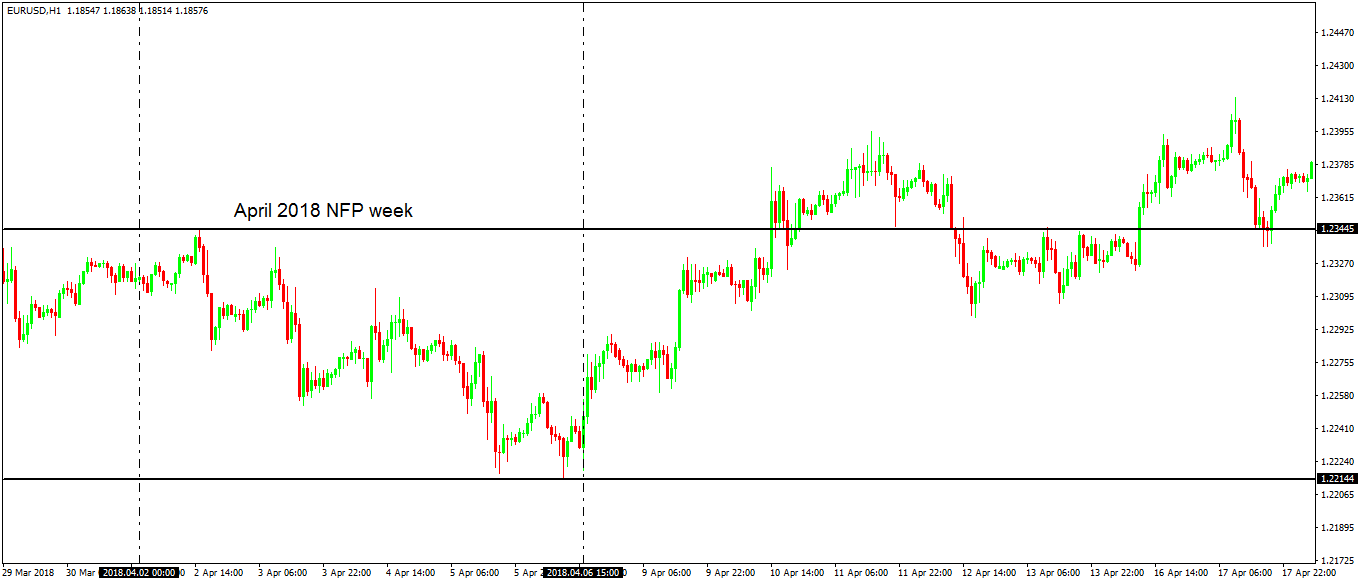

Below is the EURUSD hourly timeframe. The “fiber” pair is one of the most traded pairs, with the highest liquidity level and all retail Forex traders have some exposure on it during the trading week. Hence, it is the perfect example to illustrate the NFP ranging, due to the relatively high liquidity.

The vertical lines show the NFP week for April 2018. While the general trend was bearish, the market moved in a whipsaw mode, giving something to both bulls and bears.

That is, if you traded on the scalping side, looking for short to very-short-term profits. After all, the range was quite small, from 1.2344 to 1.2214 from the week’s opening until the NFP release on Friday. Hence, one hundred pips from top to bottom for a trading week…not something for swing traders, not to mention investors, right?

An approach based on the U.S. Dollar’s events gives flexibility to the trading plan. For example, a trader might be bullish on the dollar on the medium to long-term approach but still sell on a scalping basis due to the likelihood of a range to form.

Mind Central Banks Rate Decisions

In Forex trading, central banks have the power to move the markets. That is true not only in the currency market but also in others, like the stock market.

This is due to the interest rate and the way the monetary policy shifts. Nowadays, rarely do we see a central bank taking markets by surprise.

The forward guidance principle was introduced to make sure the market participants understand the message sent and there would be no surprises when the interest rate decision was announced.

However, despite the forward guidance principle, traders shifted the focus to the press conference and the implied future path of the interest rate level.

Hence, the press conferences have the power to move the markets like no other economic events. The good thing is that traders know when they are scheduled and may opt to avoid trading related products.

For example, trading the CAD (Canadian Dollar) or the oil market during the Bank of Canada interest rate decision and press conference requires a longer-term perspective than a trading week because the market swings are big enough to take out any stop-loss order.

Use Pending Orders as Often as Possible

That’s Forex trading planning at its best! Before anything, using pending orders is a sign of a plan. It shows discipline and analysis in place.

Traders may choose to sell from higher levels, using pending sell limit orders, or buy from higher levels, using pending buy stop orders. Or, they may want to sell or buy from lower levels than the current market ones.

Forex trading gives this possibility, and it is a great approach when identifying ranges or when trading with a trading theory that gives an exact entry. For example, the Elliott Waves Theory is fully dependent on Fibonacci ratios and levels. As such, placing pending orders on specific market retracements (e.g. 61.8%) or expansions (e.g. 161.8%, 423.6%).

If and when the market reaches the entry point, the platform will execute the trades accordingly. If not, ranges still dominate.

Talking about ranges, some trading platforms offer an OCO (One Cancel Other) order. Even the MetaTrader4 and 5 can import an indicator that allows the feature.

Traders use it to define a range. More precisely, to set the break from a range. Either higher or lower, the order will execute the break and will cancel the opposite one.

Unfortunately, many retail traders avoid using pending orders. Impulsivity, the need to be part of the action and the adrenaline, are factors that lead to bad trading decisions.

Don’t Ignore the Bigger Picture

Checking the bigger timeframes like the monthly and weekly one never hurts. That is, despite trading on the short to very-short time-horizon.

Traders focus on patterns that don’t consume much time, like Japanese Candlesticks. Hence, they focus on potential reversal patterns like hammers, engulfing patterns, piercing or Doji, etc. and place pending orders if the market reaches specific levels.

Conclusion

Planning the trading week starts over the weekend. It is then when traders consult the economic calendar for the week ahead and check the bigger timeframes for technical analysis.

It is over the weekend when the trading plan is made: I want to enter here, how much, what currency pairs, etc.

Next, by the time the markets open on Monday, trading begins. Ideally only placing pending orders, traders can then focus on adding to a position or doing something else, like taking care of their day job.

Yes, that is correct: almost all retail traders have a day job, so planning makes sure you still have time to perform at your regular day job while having increased chances to make an extra buck in Forex trading.