Defining Risk in Forex Trading

The risk in Forex trading refers to how much a trader is willing to lose when compared with how much the trader stands to gain. The less risk, the better the strategy.

However, risking too little has its disadvantages also: one can’t make that much either. Therefore, the key is to find the balance between the risk and reward, in such a way that the trading account isn’t exposed to massive drawdowns.

Forex trading today takes place in a rapidly changing market. Not only currency pairs are available in a Forex trading account, but also other correlated markets like the stock market, commodity or bond markets.

The risk refers to all the elements in a trading account, and to the trading account too. For example, traders have strategies for managing the risk in the trading account, which is different than managing the risk in any given trade.

A Pip in Forex Trading

When traders refer to the distance a currency pair travels, they use the term pips. Typically, a pip refers to the fourth digit in a five-digit quotation.

Hence, if the EURUSD Ask price is 1.16766 and the pair moves to 1.16966, it is said that it traveled twenty pips.

Therefore, it is common among Forex traders to refer to a loss or gain made in terms of pips, and not in real value.

For this reason, the stop loss of a trade is measured in pips too. As a matter of fact, it is indicated to be measured in pips, as the traders find out the volume to use for that particular trade.

Volume in Forex Trading

Volume is one of the trickiest variables in the trading account. It is the ultimate measurement of greed or fear, and tests traders’ limits to the maximum.

In a Forex trading account, the volume is counted in lots. However, for the retail trader, one lot may be too much to deal with.

To have an idea, on the EURUSD pair, a pip equates to $1 on a 0.1 lots trade. Hence, if the traders go long as per the example above and makes twenty pips, that’s $20 in the trading account right there. Obviously, that’s for a USD based account.

Brokers came to meet this by offering fractional trading, or trading using micro-lots. As such, even traders with a small trading account can take advantage of the opportunities in Forex trading.

So the value of a pip has a direct relationship with the volume traded. The bigger the volume, the bigger the potential reward. And, the risk.

Therefore, correlating the number of pips risked with the volume per trade is one thing. Next, the challenge comes from correlating the dollar value amount of the risk with the funds in the trading account.

Proportional Trading

Proportional trading refers to risking only a portion of the trading account on any given trade. The most common and safe approach is to use one percent risk per trade.

Attention: the proportional trading technique refers to the Equity in a trading account, not its Balance, as the Equity is what reflects the current value.

Assuming the Equity of the trading account is $10k, one percent would be $100. Furthermore, considering there is no other open trade to influence the calculation, this is the dollar risk to take for the next trade.

Naturally, when more trades are open, the Equity fluctuates until the trade sets the risk, but it can’t vary that much to influence the overall risk management strategy in the trading account.

If $100 is the risk, the next step is to define the pips risked per trade. This is a bit trickier as it depends on the trading strategy.

For the sake of using the most popular trading theory, the Elliott Waves Theory, let’s assume the trader buys a pullback considered the 2nd wave in an impulsive move.

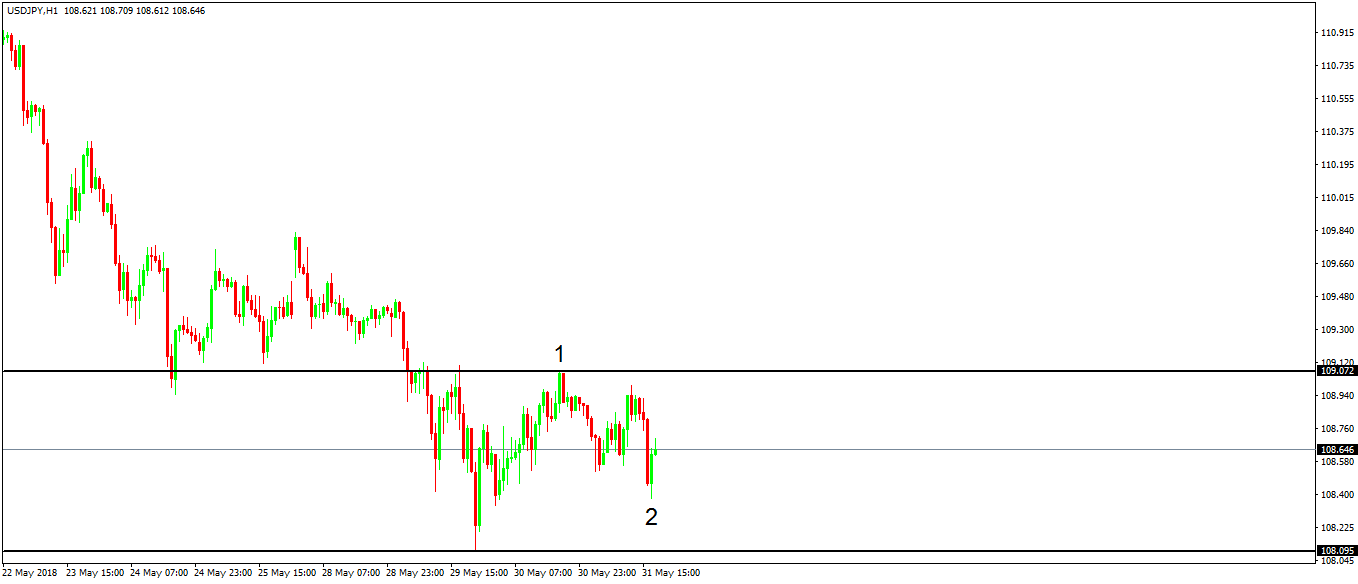

This is the USDJPY hourly chart. As mentioned above, let’s assume that, according to the top/down analysis, the impulsive move of the Elliot Waves Theory is about to start.

In any impulsive move, the 2nd wave can’t travel beyond the start of the 1st wave. Hence, we have the maximum distance in pips that the pair can travel before invalidating the scenario. Or, the stop-loss level.

In this case, it is approximately fifty-five pips. However, we also know the dollar risk for any given trade so that it respects the proportional trading technique: 1% or $100 for the above-mentioned trading account.

The next thing to settle is to make the connection between the two. And that’s where the volume comes into the equation.

We need to find out how a $100 risk relates to 55 pip distance, in order to find out the correct volume for the trade. If 0.1 lots are about $1/pip, it means that a 55 pip distance equates to $55 when traded with 0.1 lots. That’s too little as the volume for this trade.

Using simple math, 0.19 lots or even 0.2 (to make it a round number), respects the one percent rule giving the dollar and pips risked.

The same principle is valid for any trading strategy, and it helps to find the risk on any trade, even if it is derived from monthly timeframes. All you need to do is to convert the pips into lots by using the volume as the primary tool to do that.

We won’t go into detail regarding the reward aspect now, as we’ll cover the most critical aspects of trading with a risk-reward ratio further in a different article of this trading academy.

Instead, the focus here is to mix the stop needed for the trade, with the defined percentage, so that we can find out the right volume to trade. Even if the trade hits the stop loss, the account won’t be affected by more than one percent, as per the proportional margin technique used.

Conclusion

Numbers don’t lie. They tell a very accurate story, one that many traders refuse to admit.

Using one percent as the risk per any given trade, even seventy-two consecutive losses won’t cause more than a fifty percent drawdown in the trading account.

While this is quite a drawdown, it rings a bell that the trading strategy isn’t the right one with so many consecutive losses. Therefore, the trader has the chance to start over again: withdraw the money, invest in education, and come back with a new strategy, but using the same money management system.

Without clearly defined risk, traders can’t survive in the long run in Forex trading. A typical drawdown cannot reach more than twenty percent of the trading account, and that is the maximum limit admitted to the life of a trader.

Trading for a living implies pressure from all parts: from the market, as it may not move as much as traders want, from human nature (greed and fear) and from the pressure to make it day in and day out.

Defining the risk is only the first step of a sound money management principle. In this last part of our trading academy, we’ll cover the bumps in the road to profitability but also the ins and outs of trading for a living.

Stay tuned!