FXTM Review

Min Deposit

$5

Leverage

1000:1

Deposit Bonus

up to $300

Regulation

FCA

CySEC

IFSC

FSB

Platform

MT4

MT5

FXTM has been in operation since 2011 and has more than 3 million users. It is regulated by respected bodies across the world, including the FCA and CySEC. It focuses on the most popular financial trading instruments and offers a cost-effective solution. With a range of account types, useful resources, and an easy-to-use offering, FXTM is a good choice for a wide range of traders.

FXTM Introduction

Forextime or FXTM for short has been around since 2011 and caters to forex and CFD traders all across the world. The company has its headquarters in Cyprus and it is under the oversight of numerous notable financial regulators, such as the Financial Conduct Authority (FCA) in the UK, as well as the Cyprus Securities and Exchange Commission (CySEC).

It currently has more than 3 million clients across the world and specializes in leveraged trading. It covers everything from forex, indices, shares, commodities, and cryptocurrency trading. Over the years, FXTM has won numerous awards from different bodies in the trading space.

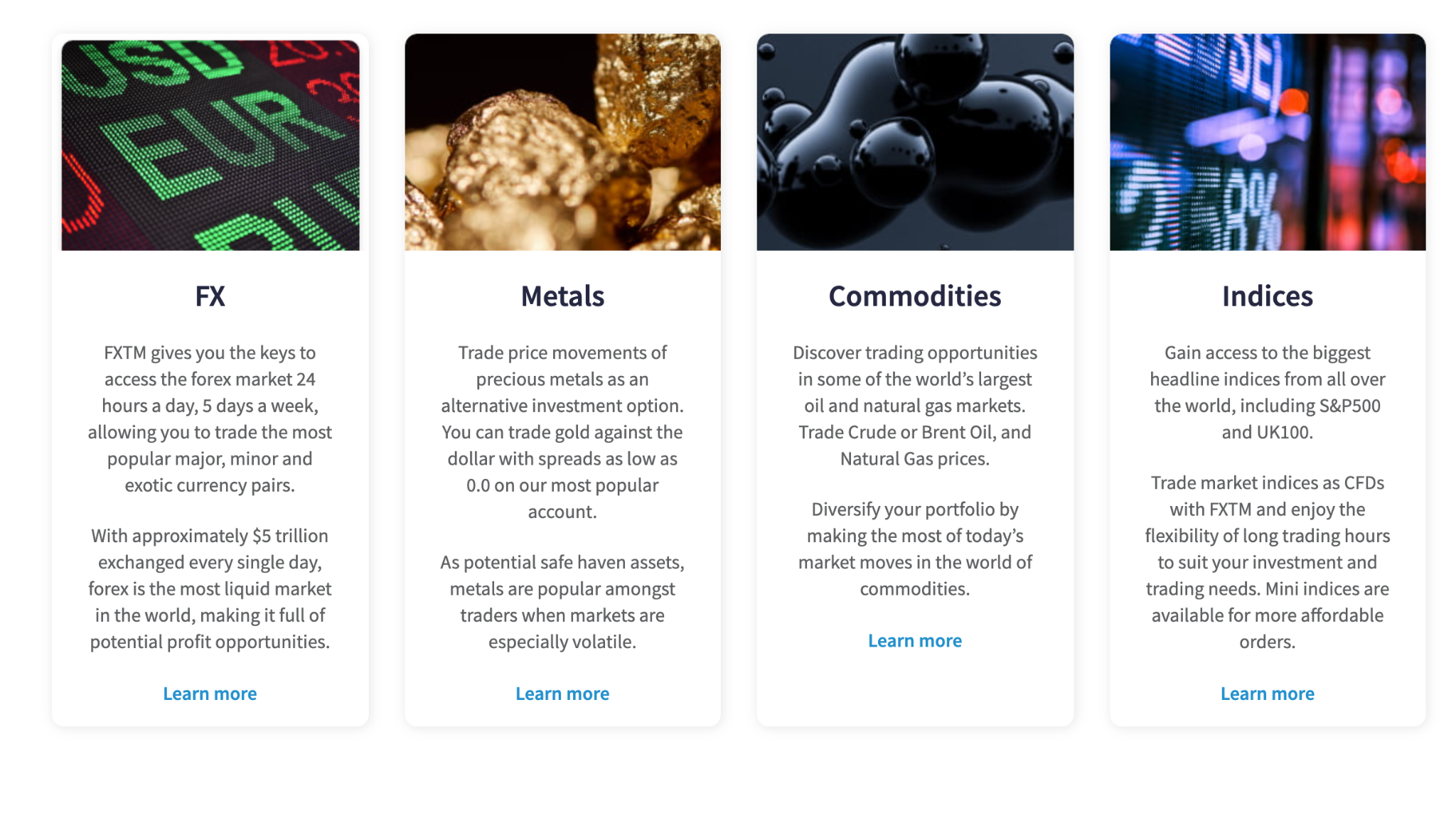

FXTM Products

There are hundreds of different instruments that you are able to trade through your FXTM account. This covers all sorts of forex currency pairs, precious metals, indices, shares, commodities, cryptocurrencies, and CFDs. You will get access to more than 50 currency pairs, as well as many major cryptocurrencies. While the selection is not as vast as other brokers, FXTM offers all of the most popular options.

FXTM Trading Conditions

One of the areas that FXTM specializes in is offering extensive leverage to its base of users. The amount of leverage available does depend on your account type, as well as the instruments that you are looking to trade. Leverage at FXTM can go as high as 1:100 when you satisfy certain conditions. However, European and UK residents are subject to stricter leverage limits, usually going no higher than 1:30 leverage.

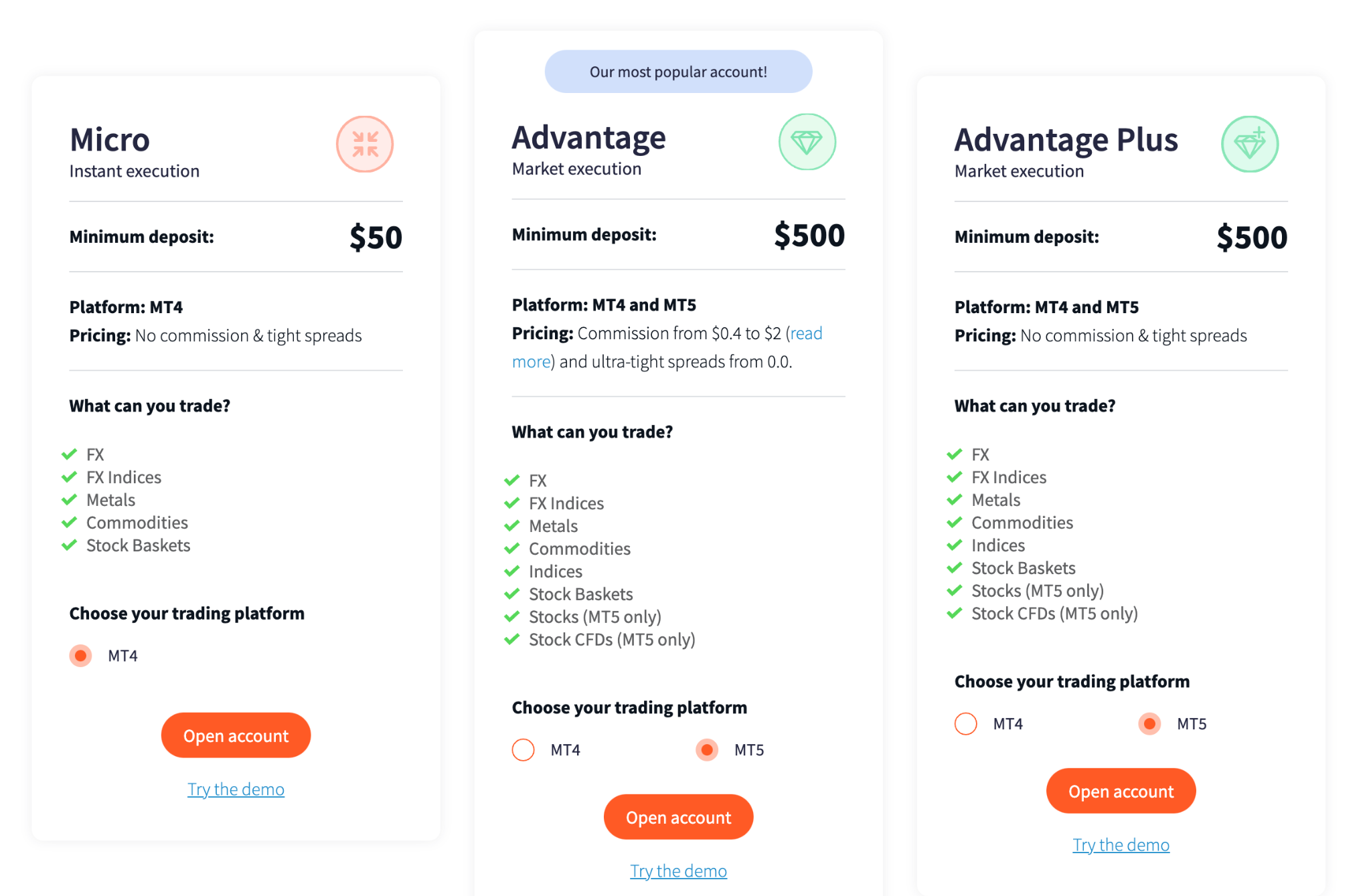

FXTM Account Types

There are three main types of FXTM trading accounts for you to choose from. These cater to a different range of people. The Micro account is ideal for beginner traders, having a minimum required deposit of just $50 and offer instant execution. It only caters to MetaTrader 4 and you don’t have the most extensive ranges of instruments to trade.

The Advantage account is the most popular option on FXTM, allowing for market execution and a minimum deposit of $500. It offers you the choice between MetaTrader 4 and MetaTrader 5. Finally, Advantage Plus is a no-commission account that also has a $500 minimum deposit and offers both types of MetaTrader platforms. You also have the option to start a demo account if you want to test out your trading with virtual funds.

FXTM Commissions & Fees

The three different account types have their own distinct fee structures. For the Micro account, there is no commission charged and tight spreads. For the Advantage account holders, the commission per trade will range between £0.40 and £2, with there being ultra-tight spreads. Finally, for Advantage Plus accounts, there will be no commission charged and tight spreads. The average spread for EUR/USD is 1.5 pips, which compares well with the industry average.

FXTM Platforms and Tools

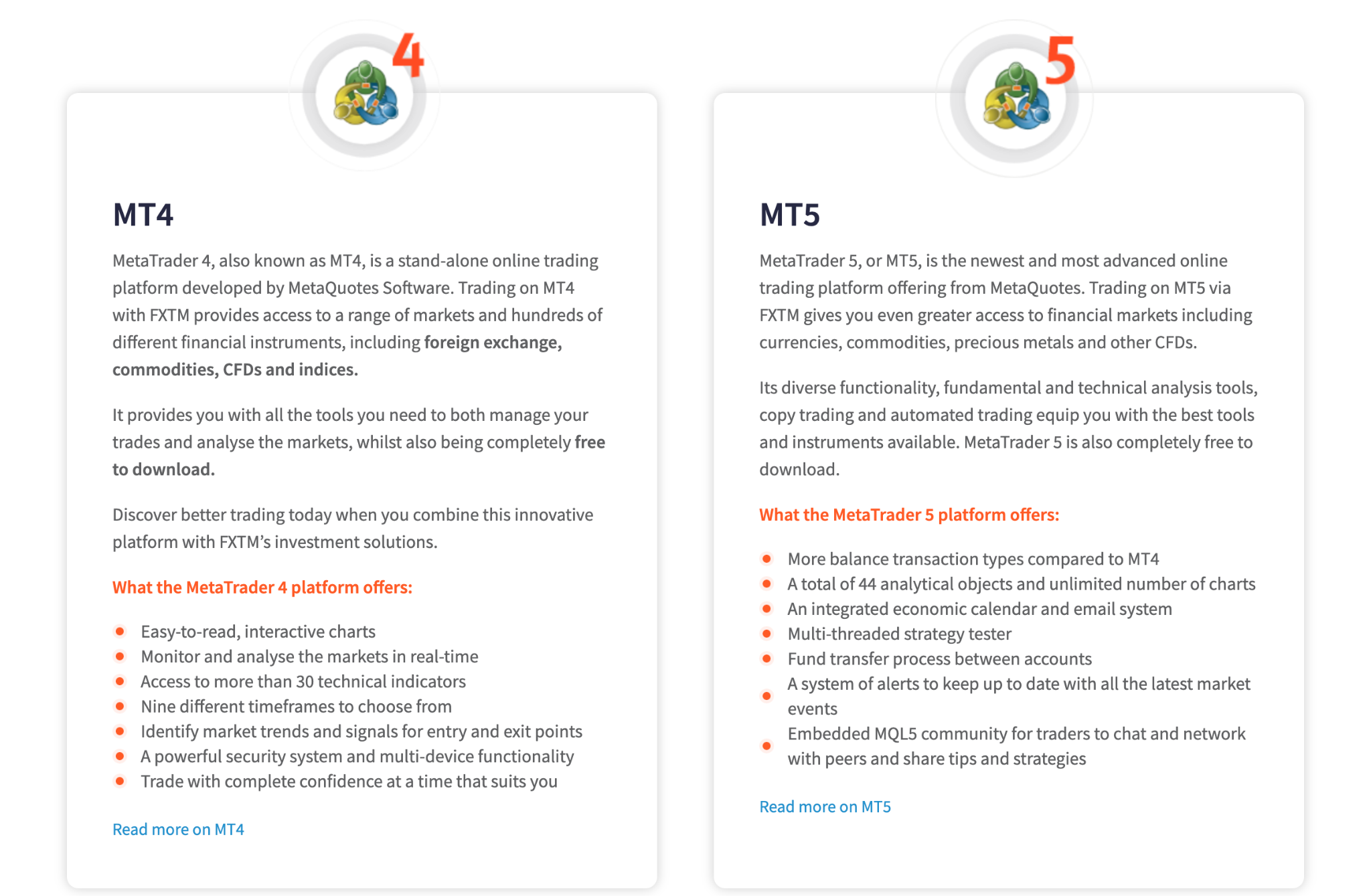

For FXTM traders, you are able to choose between the industry standard MetaTrader 4 and MetaTrader 5 platforms. These both have won many awards over the years for their performance features. They are accessible on all popular devices.

You also have the ability to engage in automated trading through FXTM. This allows you to put a strategy in place and have it carried out for you in a passive manner. There is also a social trading side of the offering that allows you to follow the trades of ranked strategy managers.

Is FXTM Mobile Friendly?

Yes, you can access FXTM through your mobile device, no matter if you are using an iOS or Android mobile phone. This can be done by downloading the respective FXTM app. This app has been optimized to work seamlessly on mobile and will still have a great selection of features and options. You can customize the design depending on your needs and you can enact alerts.

FXTM Promotions

FXTM was not running any active promotions at the time of writing this review.

FXTM Deposits & Withdrawals

FXTM offers many different ways for people to fund their accounts. To make a deposit, you are able to use popular credit card and debit card providers like Maestro, MasterCard, and Visa. Popular e-wallets like Skrill, Neteller, and dotpay are options, while you will also usually have wire transfer as a choice.

The bank transfer will take 3-5 business days to process, while the other deposit options see your funds reach your account in two hours. There are no fees associated with deposits and the supported currencies can vary depending on what option you choose.

To make a withdrawal for your FXTM account, you can use Visa, MasterCard, Maestro, Skrill, Neteller, and a bank transfer. There is a £2 fee for withdrawing through a card, no fee for e-wallet payouts, and a £25 fee for a bank transfer. Bank transfers take about 24 hours to process withdrawals, while the other options will usually process in the same business day.

FXTM Customer Support

FXTM has a useful help section that provides you with a lot of information regarding a range of topics. This can offer solutions to many problems that you might be running into. If you wish to speak directly with the FXTM customer support team, you are able to ring them by phone between 8am and 6pm from Monday to Friday. You are also able to use the live chat, as well as send the team an email. Finally, FXTM is active on numerous popular social media channels.

FXTM Research and Education

FXTM has a decent education offering, with many educational events being held on a regular basis across the world, both virtually and in person. You also have tons of different educational resources available online. These range from webinars, to trading platform tutorials, seminars, trading tools, news reports, calculators, calendars, market analysis, and outlooks.

The overall research section at FXTM ticks all of the boxes, as you have many different resources at your disposal. You can access trading tools that have been based on technical analysis and there is a solid range of charting tools.

Noteworthy Points to mention for FXTM

The ease of use of the FXTM platform is a clear standout, as is the competitive cost structure and fast withdrawals. One area to note is that it does not have the largest collection of financial trading instruments.

Conclusion for FXTM

FXTM is a well-regulated online broker that inspires confidence into traders of all experience levels. The platform couldn’t be easier to use on both mobile and desktop devices. There are plenty of great resources and customer support available to you.

While the range of trading instruments isn’t as vast as some competitors, there is a competitive fee structure and ultra-fast execution available. This is an ideal offering for those people who are looking to trade the main financial instruments in a cost-effective and easy manner.

User Reviews

5

based on 1 rating

Recovery/investment advice/hacker for hire

I have gotten back all my lost fund and bonus from binary option. They stocked all my trading capital and deprived me access into my account for over two months now, after I’ve invested $200K with my hard earned money. Thought I was not gonna see this day, but as God may have it, today I’ve got back all my money back for real. I will forever remain grateful to God. If you’ve been locked out from logging into your binary option trading account or you are unable to make withdrawal from your brokers account or you need an advice on where and how to invest in any broker maybe because your broker. kindly reach out to hightechcoininvestment @ gmail com Whatsapp:+1(704)7690765 and they will guide you on steps to take to regain access to your account, make withdrawal freely and easy, as well as recover all your lost funds