Exness Review

Min Deposit

$1

Leverage

200:1

Deposit Bonus

Promotions

Regulation

FCA

CySEC

Platform

MT4

MT5

MT4 Web

Exness is a retail trading offering that is regulated by the FSCA and FSA. Having been around since 2008, it has an impressive offering with more than 200 tradable instruments on offer. With competitive fee structures, various accounts types, and fast execution, it is a popular choice among traders. Added to this is the solid range of trading platforms and 24/7 customer support.

Introduction

Exness is an online broker that was started in 2008 and it has its registered office in Seychelles and the head office in Cyprus. It is regulated by the likes of the Financial Sector Conduct Authority (FSCA) in South Africa and the Financial Services Authority (FSA) in Seychelles. Exness was started by a group of professionals in the IT and finance spaces and although it no longer caters to European traders, it does offer B2B services through the UK branch.

Exness is now considered to be one of the leading online brokers, having won numerous retail trading awards over the years. It has a focus on providing a trustworthy and secure trading environment. It focuses heavily on educating its traders, to help them enhance their skills. The broker supports 15 languages and offers around-the-clock customer support. This Exness review will look at each of the core parts of this offering.

Exness Products

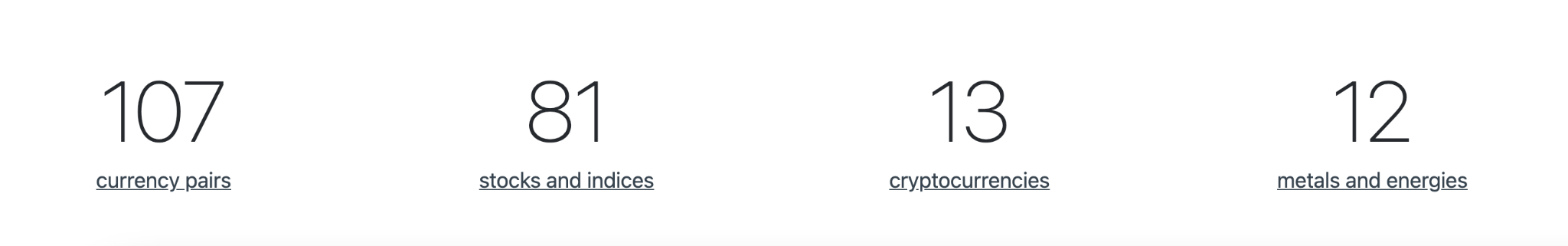

There are more than 100 different currency pairs that you are able to trade through Exness, as well as 90+ CFDs for indices and stocks, metals, energies, and 13 different cryptocurrencies. Overall, there is a great range of products available to traders at Exness.

Exness Trading Conditions

Exness has developed a good reputation when it comes to execution speeds with trades going through almost instantly. It also offers max leverage of up to 1:2000, so there is plenty of opportunities for traders to increase their positions as needed.

The available leverage does vary depending on your account type, trading platform, and the instruments you are trading. The margin call for standard accounts is 60% and it is 30% for professional trading accounts.

Exness Account Types

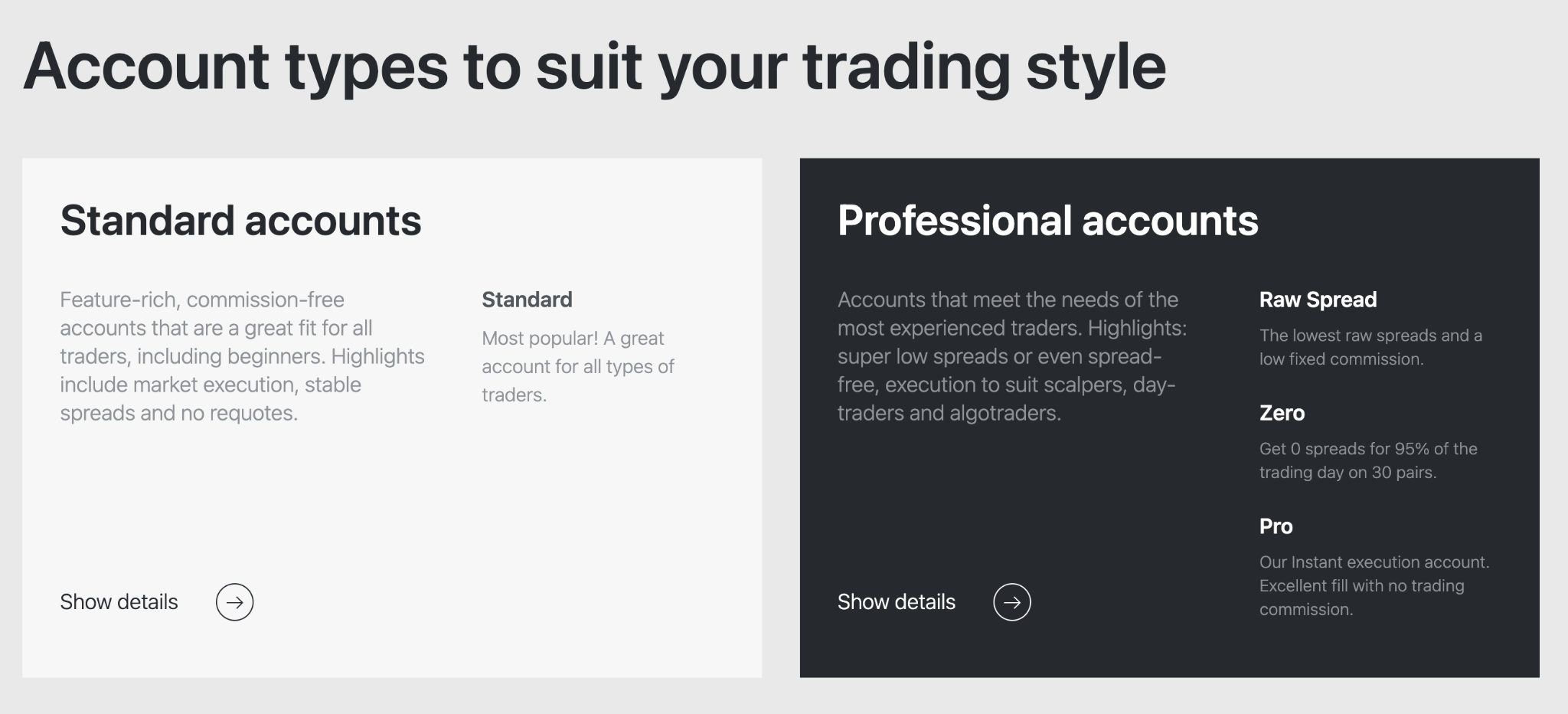

Exness offers five different account types in total, catering to both retail traders and professional traders. For smaller traders, there is the Standard Cent Account, while the Standard Account is the most popular option. For professional traders, the ECN Account type offers better spreads and lower commissions.

Exness Commissions & Fees

Exness aims to have tight variable spreads. For the Standard Cent Account, the spreads will begin at 0.3 pips and there will be no trading commission to consider. For the Standard Account, the tight spreads begin at 0.1 pips. For the Professional ECN Account, you will be looking at a raw spread, as well as a commission for each trade. There will be an overnight cost to consider if you are holding positions for more than a day.

Exness Platforms and Tools

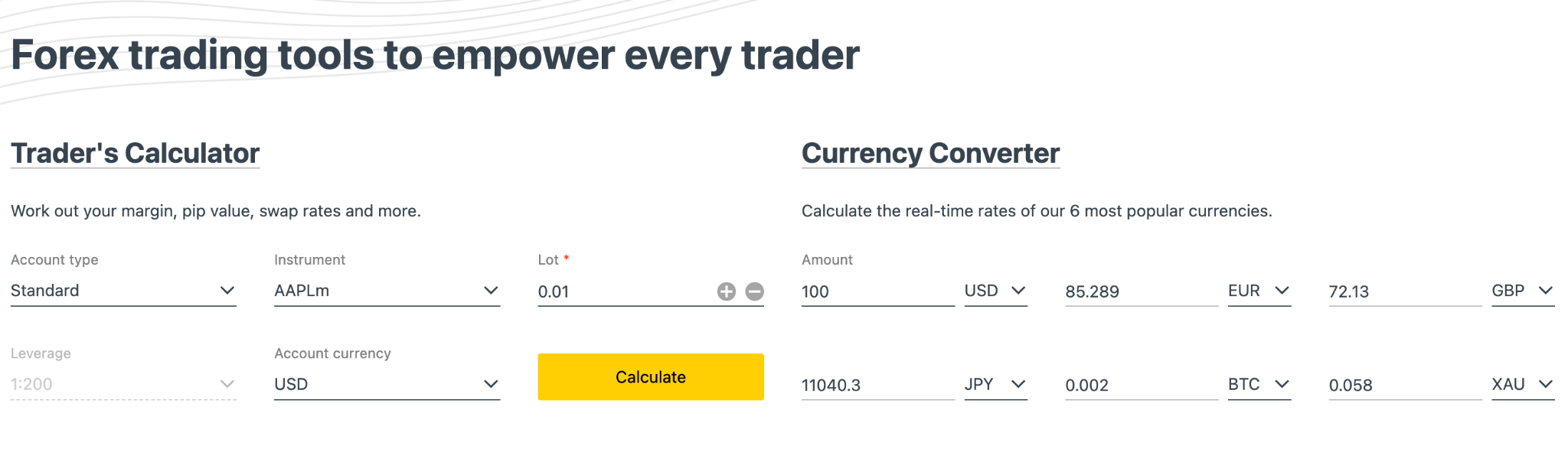

Exness offers you the chance to use either MetaTrader 4 or MetaTrader 5. There are also mobile platforms you can use, as well as the MetaTrader 4 WebTerminal. The platforms are compatible with most leading types of operating systems, making them ideal for a wide range of traders.

You get access to a good range of different tools and features, as well as catering to all of the popular trading styles. You also get access to the latest news streams, as well as free technical analysis tools, VPS hosting, economic calendars, constant account monitoring, and quotes history.

Is Exness Mobile Friendly?

Yes, Exness is mobile-friendly, having dedicated trading platforms for mobile traders. These apps are fully equipped with all necessary trading features, as well as supporting popular iOS and Android devices. You can download these apps straight from the Apple App Store or the Google Play Store. Some of the different features on offer include the availability of multiple order types and a simple-to-use interface.

Exness Promotions

At the time of writing this review, Exness was not offering any type of promotion for people signing up for a new account nor for existing Exness traders.

Exness Deposits & Withdrawals

There are no fees charged by Exness for transactions. You are able to make deposits using a bank wire transfer, popular credit card, and debit cards, as well as popular e-wallets like Neteller and Skrill and cryptocurrencies.

There is a small minimum required deposit for the standard accounts, but there is a $200 minimum for the professional account. Some transaction options may have their own limits that you need to consider.

Withdrawals are also available by using the same types of transaction methods. For e-wallets, withdrawals are usually processed instantly. Cryptocurrency transactions can take a day or two, while card withdrawals often require 3-5 days.

Exness Customer Support

Exness offers 24/7 customer support if you are using English or Chinese. Otherwise, there is 24/5 customer support when catering to 15 languages. This means that you will always be able to get an issue with your account resolved in little to no time at all. You can choose between the likes of live chat, email, and phone support. The responses tend to be pretty quick and you will receive relevant answers that will help your situation.

If you are looking for helpful resources, there are all sorts of great information pages available on the Exness website. The FAQ section can resolve a lot of issues without you needing to contact the support team, while there are also helpful videos on how to use the trading platforms and offering as a whole.

Exness Research and Education

The Exness Academy is the educational offering that is in place with this brokerage. The aim of this offering is to help to educate traders from all across the globe. The learning materials have been created to tailor to different experience levels. This means that everyone from beginners to more advanced traders will be able to use these resources to good effect. There is everything from videos, articles, webinars, and a glossary to help you develop your skill and knowledge base as a trader.

Some of the tools that are useful for research include access to free fundamental and technical analysis, as well as a comprehensive range of research tools, trading ideas, calculators, and insights. Finally, you will discover a whole whose of Web TV, webinars, and market news resources.

Noteworthy Points to mention for Exness

Exness has built up a good reputation over the years for treating traders in the right manner. While it does not offer any promotions, it makes sure that clients are kept happy through the provision of things like free VPS services and signals. It is an offering that is not overly flashy and it has been experiencing significant growth in recent years as more and more traders turn to Exness.

Conclusion for Exness

Exness has been in the retail trading business for many years now, having started out in 2008. Over time, it has tweaked and improved its offering. With a huge range of tradable instruments being available to you and a good selection of trading platforms, Exness is a solid choice for anyone.

With the different account types, you can choose which will be most relevant to your needs and find a cost and fee structure that works for you. With fast withdrawals and 24/7 customer support, Exness ticks most boxes that a retail trader could ever want.

User Reviews

5

based on 1 rating

FINANCIAL HELP/AID

Recording the success in Cryptocurrency, Bitcoin is not just buying and holding till when bitcoin sky-rocks, this has been longed abolished by intelligent traders ,mostly now that bitcoin bull is still controlling the market after successfully defended the $60,000 support level once again and this is likely to trigger a possible move towards $90,000 resistance area However , it's is best advice you find a working strategy by hub/daily signals that works well in other to accumulate and grow a very strong portfolio ahead. I have been trading with Mr Bernie Doran daily signals and strategy, on his platform, and his guidance makes trading less stressful and more profit despite the recent fluctuations. I was able to recover my funds and easily increase my portfolio in just 3weeks of trading with his daily signals, growing my $3500 to $65,000. Mr Bernie’s daily signals are very accurate and yields a great positive return on investment. I really enjoy trading with him and I'm still trading with him, He is available to give assistance to anyone who love crypto trading and beginners on the trade market , he can also help you recover/retrieve lost or stolen cryptocurrencies, you contact him on WhatsApp : + 1424(285)-0682 , Gmail : [email protected] for inquiries , Crypto is taking over the world